Advertisement|Remove ads.

Ford Stock Steadies Overnight After Huge Earnings Miss — But A Great Chinese Challenge Emerges

- Ford’s Q4 adjusted EPS fell to $0.13, hit by supplier disruptions, tariffs, and EV pricing pressure.

- The Model e EV unit is expected to lose $4–$4.5 billion in 2026.

- BYD overtook Ford in global vehicle sales for the first time, highlighting mounting pressure from Chinese automakers.

Ford Motor Co. shares rose slightly overnight despite a sharp fourth-quarter (Q4) earnings miss, as investors weighed a more stable 2026 outlook against a rapidly intensifying competitive threat from China.

Ford Q4 Print

Ford reported adjusted earnings of $0.13 per share for Q4, below last year’s $0.39 and short of expectations. The carmaker blamed production disruptions from a fire at a Novelis aluminum supplier, higher tariff costs, and persistent pricing pressure in EVs. However, quarterly sales rose to $45.9 billion, beating estimates.

Ford guided to full-year 2026 adjusted earnings before interest and taxes (EBIT) of $8 billion to $10 billion, in line with Wall Street forecasts and higher than the $6.8 billion generated last year. Most of that profit is expected to come from its commercial vehicle business, with EBIT projected at $6.5 billion to $7.5 billion. Gas and hybrid models are expected to contribute another $4 billion to $4.5 billion.

The company also said its Model e unit is likely to post losses of $4 billion to $4.5 billion next year. It plans to increase capital spending to $9.5 billion to $10.5 billion and targets free cash flow of $5 billion to $6 billion.

The quarter included $15.5 billion in special charges tied largely to Ford’s EV strategy reset, as demand cooled and policy support weakened. The company said another $7 billion in charges is expected across 2026 and 2027.

Ford Faces Growing Competition From China

Meanwhile, Ford is facing increasing competition from Chinese automakers globally. China’s BYD overtook Ford in global vehicle sales for the first time last year as Ford’s wholesales fell nearly 2% in 2025 to just under 4.4 million vehicles, while BYD reported about 4.6 million.

Ford gained ground in the U.S., but lost share in Europe and especially China, where domestic players such as BYD, Xiaomi, and Geely are winning customers with lower-priced, tech-heavy EVs. BYD’s exports reached 1.05 million vehicles last year and are set to climb further, intensifying pressure on legacy automakers like Ford, Toyota, and General Motors.

In a bid to tackle competition in China, Ford is reportedly weighing a potential partnership with BYD to source batteries for some of Ford’s hybrid vehicles. One option under consideration involves importing BYD-made batteries to Ford plants outside the U.S.

In addition to Ford, Tesla also lost its crown as the world’s top EV seller to BYD after annual deliveries fell for a second straight year. Tesla’s annual deliveries declined by nearly 9%, while BYD delivered about 2.26 million EVs, compared with Tesla’s roughly 1.64 million.

How Did Stocktwits Users React?

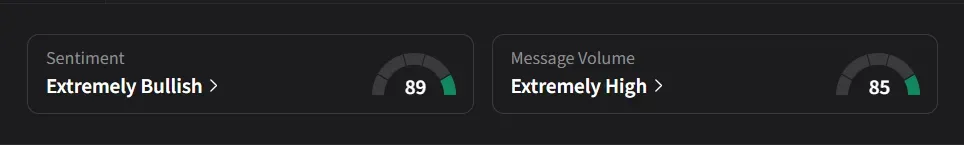

On Stocktwits, retail sentiment for Ford flipped from ‘neutral’ to ‘extremely bullish’ amid a 422% surge in 24-hour message volume.

One user said, “Didn't we already price in the losses stemming from the EV segment? We knew this was coming.”

Another user said, “as long as they pay dividends this is a good buy If they ever reduced dividend or stop it this will be at 99 cents or under”

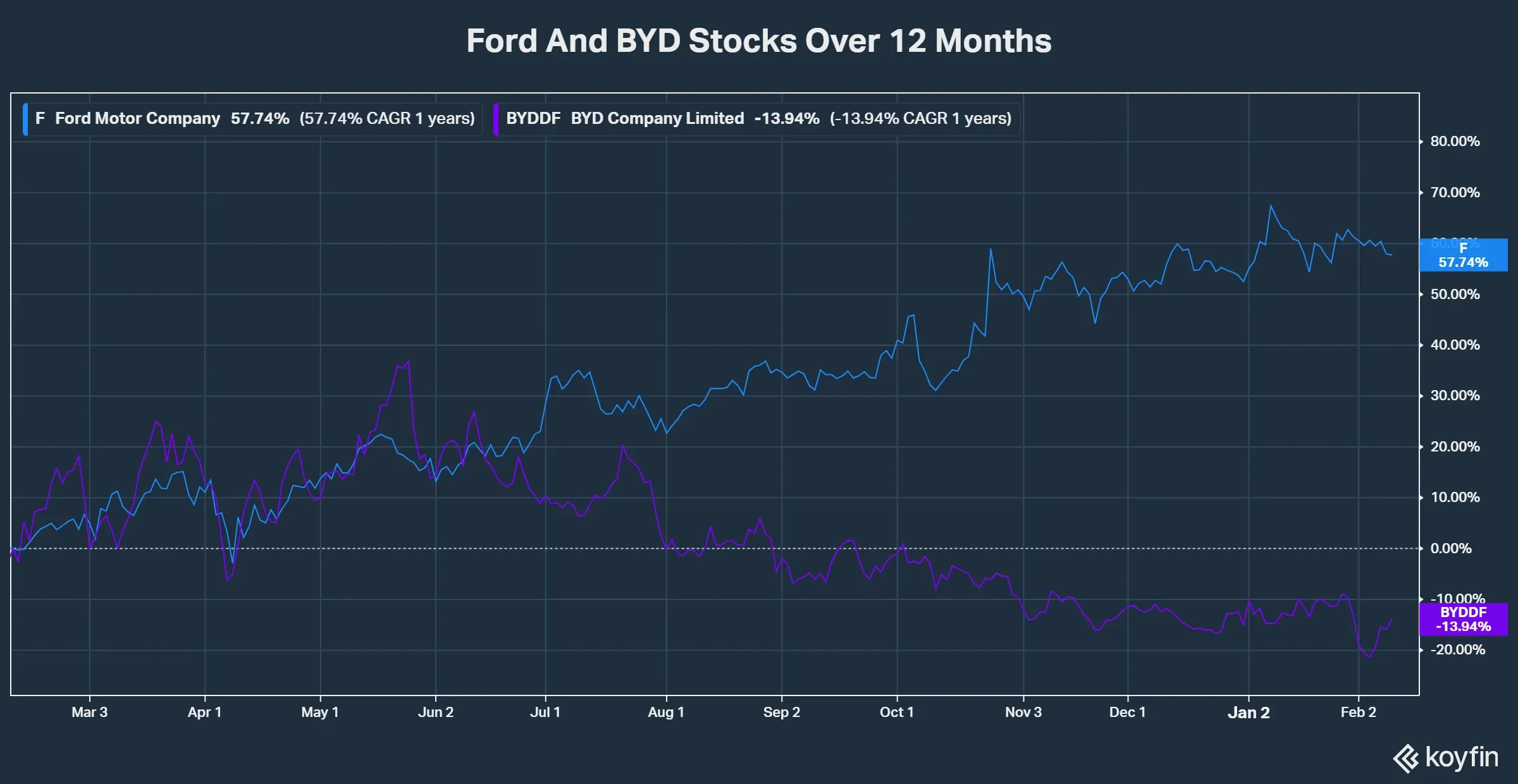

Ford’s stock has risen 56% over the past 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_changpeng_zhao_binance_CEO_OG_jpg_1f2a158765.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_iran_natanz_nuclear_facility_jpg_ca08028936.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2234618957_jpg_1c670c00ef.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2246580703_jpg_9700e1e7e8.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_cryptocurrency_generic_jpg_4184e1dbd8.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_charles_hoskinson_OG_jpg_7eaff6116d.webp)