Advertisement|Remove ads.

Freshworks Stock Rises Premarket After Analyst Predicts 19% Upside Potential: Retail Sentiment Flips To ‘Bearish’

Freshworks, Inc. (FRSH) stock was modestly higher in Thursday’s premarket session following a positive analyst action, but retail sentiment worsened.

On Thursday, UBS analyst Taylor McGinnis maintained a ‘Buy’ rating on Freshworks stock and raised the price target to $22 from $19. The updated price target suggests a scope for roughly 19% upside potential.

San Mateo, California-based Freshworks provides software-as-a-service (SaaS) products worldwide.

Citing partner checks, the analyst said demand for Freshworks products continued to be a “tale of two cities,” with Freshservice deal activity remaining robust, while Freshdesk faces pressure.

McGinnis noted that two partners with Freshservice exposure hinted at in-line to better-than-expected fourth-quarter performance. On the other hand, Freshdesk partners painted a soft fourth-quarter demand picture and also sounded cautious regarding the fiscal year 2025, he added.

The UBS analyst expressed worries concerning the fourth-quarter earnings setup due to the forex moves and a modest acceleration implied by the company’s fourth-quarter organic billings growth guidance

The company is scheduled to announce its fiscal year 2024 fourth-quarter results after the market closes on Feb. 11. Wall Street analysts model fourth-quarter non-GAAP earnings per share (EPS) of $0.10 and revenue of $189.5 million.

Freshworks’ guidance issued in early November calls for non-GAAP EPS of $0.09 to $0.10 and revenue of $187.8 million to $190.8 million.

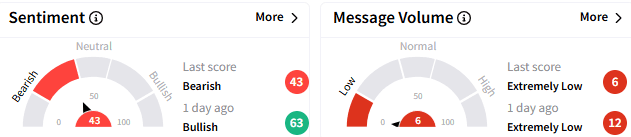

On Stocktwits, sentiment toward Freshworks stock deteriorated to ‘bearish’ (43/100) from the ‘bullish’ mood that prevailed a day ago. The message volume tapered off further to ‘extremely low’ levels.

In premarket trading, Freshworks stock rose 0.54% to $18.60. The stock has gained over 14% this year, reversing some of the 31% loss in 2024.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_140648412_jpg_05552b4117.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_912727778_jpg_3bd44c57ad.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1235943608_jpg_91702ef0ab.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_167578473_jpg_29255f031f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Michael_Burry_jpg_fa0de6ac92.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_winklevoss_1c7de389e0.webp)