Advertisement|Remove ads.

Galapagos Announces CFO Exit With No Successor Named Yet: Retail’s Disappointed

Shares of biotech Galapagos NV (GLPG) dipped nearly 1% in pre-market trade on Tuesday after the company announced the departure of its CFO and COO, Thad Huston, effective August 1, 2025.

The company said Huston has decided to leave and return to the U.S. for personal and professional reasons. It added that it expects to announce a new CFO “in the coming months,” but did not share a definitive timeline.

Huston joined Galapagos in July 2023 from Kite Pharma, Inc. Before that, he worked for over 25 years at Johnson & Johnson.

CEO Paul Stoffels said that Huston will stay in his role until Aug. 1 to “ensure a smooth handover of responsibilities.”

Galapagos, which has operations in Europe and the U.S., reported its full-year 2024 financial results earlier this year. The company logged a 15% jump in total net revenue to €275.6 million (about $312 million), while diluted earnings per share fell to $1.12 from $3.21 year-over-year (YoY).

As of the end of 2024, it had €3.3 billion in cash and financial investments and said that it intends to separate into two publicly traded companies and establish SpinCo with approximately €2.45 billion in current cash.

A shareholder meeting regarding the separation of Galapagos into two publicly traded entities is expected to be convened in mid-2025.

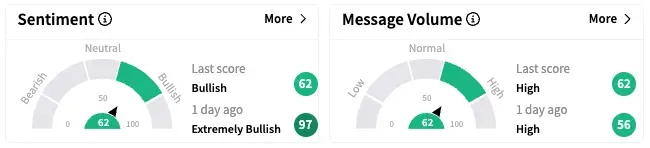

On Stocktwits, retail sentiment about Galapagos fell from ‘extremely bullish’ to ‘bullish’ territory over the past 24 hours while message volume remained at ‘high’ levels.

GLPG stock is down by over 13% year-to-date and by nearly 19% over the past 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com

(Exchange Rate: 1 Euro = 1.13 USD)

/filters:format(webp)https://news.stocktwits-cdn.com/large_tesla_fsd_jpg_e90331e6a6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2210921290_jpg_46bb1e6211.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_figma_original_jpg_90603f536b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2213245133_jpg_7b8ad24799.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Carvana_jpg_86121a5fd5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1234770702_jpg_792acca270.webp)