Advertisement|Remove ads.

GE Stock On Track To Hit All-Time High: Morgan Stanley Calls It A ‘Structural Winner’, Flags 27% Upside

- Morgan Stanley’s price target represents a 27% upside to Thursday’s closing price of $334.74.

- The firm sees further upward revisions to GE Aerospace’s earnings and free cash flow.

- Morgan Stanley views the stock’s risk/reward profile as attractive, with a favorable skew of about 2.9 times at current levels.

Shares of GE Aerospace jumped to a record high in pre-market trading on Friday after the company received a bullish nod from Morgan Stanley, calling it a ‘best-in-class’ aerospace and defense company.

Morgan Stanley initiated coverage of the stock with an ‘Overweight’ rating and a price target of $425, according to The Fly. This represents a 27% upside to Thursday’s closing price of $334.74.

GE climbed above 1% and was among the top trending tickers at the time of writing.

Morgan Stanley Sees GE Aerospace As A ‘Structural Winner’

The firm highlighted GE Aerospace’s ‘deep competitive moat’ in an industry with high barriers to entry and long product cycles, noting that the company is well positioned as a structural winner, supported by steady demand for aircraft engines and services.

Morgan Stanley expects further upward revisions to earnings and free cash flow, highlighting confidence in the company’s long-term growth prospects. At current prices, the firm views the stock’s risk/reward profile as attractive, with potential gains significantly outweighing losses. It estimates a favorable skew of about 2.9 times.

According to TradingView data, GE Aerospace has a price-to-earnings (P/E) ratio of 40.5, compared to Lockheed Martin’s (LMT) P/E of 30.2.

American Airlines Chooses CFM Engines For Airbus A321neo Fleet Expansion

On Thursday, American Airlines (AAL) said its upcoming Airbus A321neo deliveries will continue to be powered by CFM International’s LEAP-1A engines, with CFM also providing long-term maintenance support. CFM is a 50/50 joint venture between GE Aerospace and Safran Aircraft Engines.

In addition to its CFM-powered fleet, the airline operates Boeing 777s with GE90 engines and Boeing 787 Dreamliners with GEnx engines, with more aircraft on order.

Earlier this month, GE Aerospace also unveiled a $300 million multi-year investment plan to expand its engine component repair capacity in Singapore through 2029.

Strong Q4 Print To Drive Stock Price In 2026

GE Aerospace reported strong fourth-quarter results last month, revenue growing 17.6% year-on-year to $12.72 billion, earnings rising by 32% to $8.05 per share, and operating profit margin soaring 21.4% to 70 bps. Its total orders jumped to $66.2 billion, up more than 32%

The company also expects a low-double-digit revenue growth and adjusted EPS of $7.10 to $7.40 in 2026. The results led to a slew of bullish brokerage actions, with UBS stating that the higher numbers are expected to drive the stock in 2026.

What Are Stocktwits Users Saying?

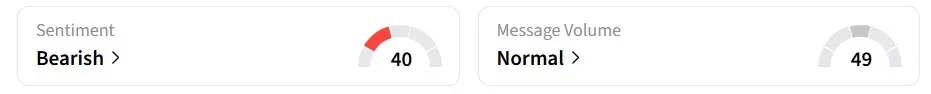

Despite the favorable recent developments, retail sentiment on Stocktwits has remained in the ‘bearish’ zone for over a month.

One user called the stock “ridiculously expensive” and pegged its fair Value at $220.

Another user noted that the stock remains in a clear uptrend after breaking past a key resistance level.

Year-to-date, GE shares have gained nearly 10%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trump2_jpg_ad63f384b5.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1247400381_jpg_765e6ec016.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_atm_original_jpg_afc73e9be7.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_GE_Aerospace_resized_1_jpg_03f4fd7e4e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2260447662_jpg_cd246b74f6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2254924116_jpg_d54ffea07e.webp)