Advertisement|Remove ads.

GE Vernova Stock Pares Gains Post Recent Rally: Retail Ignores Guggenheim Downgrade

GE Vernova’s (GEV) shares fell 4.7% on Friday, paring some of the gains made in recent times.

Notably, Guggenheim downgraded the stock to “Neutral” from “Buy.” According to TheFly, Guggenheim analyst Joseph Osha also removed the prior price target of $380 alongside the downgrade.

The firm noted that the stock is now fairly valued, and the revised rating reflects the stock’s strong recent performance.

Guggenheim also said that the speed of upward revisions in GE Vernova's financial model is likely to slow, which makes additional upside to valuation based on core earnings and free cash flow "less likely."

The stock hit an all-time high on Wednesday after the power equipment maker’s fourth-quarter profit more than doubled.

Several analysts viewed the stock more positively and raised the price target.

According to TheFly, BofA Global Research raised the stock's price target to $485 from $415 and kept a “Buy” rating.

The BofA analyst reported that the company’s higher multiple reflects continued order strength and is a premium to the peer average, reflecting the faster earnings trajectory.

Argus analyst John Eade also lifted the price target to $500 from $330 and said while the company’s recent profit record has been spotty, a turnaround is underway, and the outlook for near-term growth is promising.

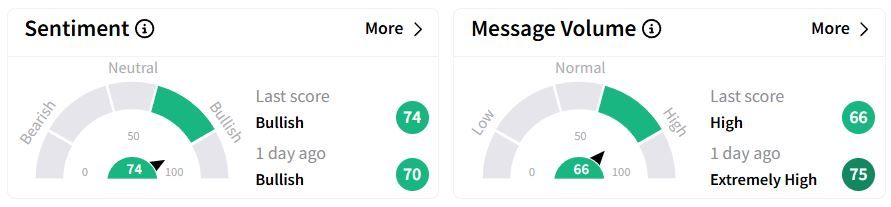

Retail sentiment on Stocktwits remained ‘bullish’ (74/100), albeit with a slightly higher score than a day ago, while chatter remained ‘high.’

Some users saw an opportunity to buy the stock as prices pulled back; others commented that a decline was inevitable.

Over the past year, the stock has more than tripled in valuation.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Solana_722b6a3879.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_X_Elon_Musk_274c6a8683.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_kevin_o_leary_OG_jpg_2789641a97.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2200882557_jpg_53f3e467bc.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2260269284_jpg_cf42b9b8c3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Patrick_Witt_d5f3eaa4da.webp)