Advertisement|Remove ads.

Gene Munster On AI, Jobs And What C-Suite Won’t Talk About

- Munster highlighted Amazon’s layoffs and noted how CEO Andy Jassy attributed the cuts to a cultural decision.

- The veteran tech analyst said that despite Jassy’s explanation, AI is still the primary driver of a leaner organization.

- Other firms like Citigroup are also continuing job cuts in 2026, as part of reorganization efforts that reflect efficiencies gained through technology.

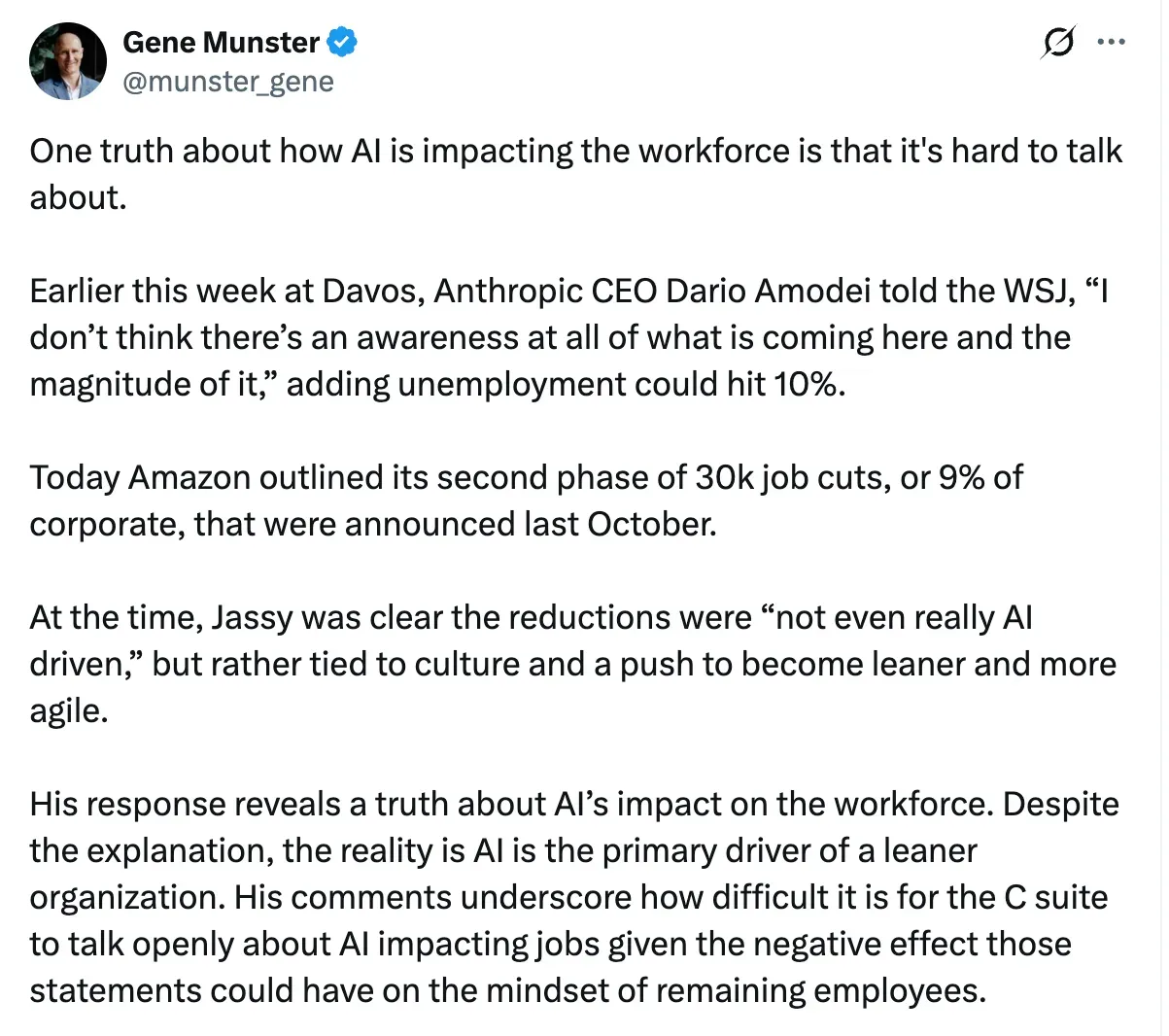

Deepwater Asset Management co-founder Gene Munster said one reality about the growth of artificial intelligence is that it is increasingly difficult for top leaders to talk about its impact on the workforce.

In a post on X on Friday, the veteran tech analyst highlighted Amazon’s layoffs and noted how CEO Andy Jassy attributed the cuts to a cultural decision that came in a bid to become a leaner and more agile organization.

“His response reveals a truth about AI’s impact on the workforce. Despite the explanation, the reality is AI is the primary driver of a leaner organization,” Munster said in the post.

“His comments underscore how difficult it is for the C suite to talk openly about AI impacting jobs given the negative effect those statements could have on the mindset of remaining employees,” Munster added.

AI’s Impact On Jobs

Munster also noted Anthropic CEO Dario Amodei’s comments to the Wall Street Journal at Davos earlier this week. In the interview, Amodei talked about AI development and the fields most at risk of AI-driven employment disruption.

Munster highlighted Amodei’s comments about how there isn’t an awareness of the magnitude of what is to come with regard to AI’s impact on unemployment, which could hit 10%.

Recently, Microsoft co-founder Bill Gates also outlined the major disruption that AI could cause on employment. Gates noted in a blog post that AI had progressed enough to begin disrupting software development and warned that once it grew more capable, job disruption would be more immediate. He also cautioned that the impact will grow further over the next five years.

Recent Job Cuts

Earlier this week, reports emerged about Amazon planning to lay off about 14,000 people, adding to the 14,000 from October last year. The e-commerce company reportedly said in an internal letter that the latest generation of AI has been the most transformative technology and is enabling companies to innovate much faster.

However, CEO Jassy had told analysts during the company’s third-quarter earnings call that the reductions were not financially-driven or even AI-driven.

Meanwhile, Citigroup is also continuing its job cuts in 2026, as part of its CEO’s reorganization efforts, which the company said aligns with current business needs, and also reflects the “efficiencies we have gained through technology and progress against our transformation work,” the company said.

Meanwhile, U.S. equities closed higher on Friday. The SPDR S&P 500 ETF (SPY), which tracks the S&P 500 index, closed up around 0.04%, while the Invesco QQQ Trust ETF (QQQ) ended the day 0.32% higher. The tech-heavy Nasdaq-100 (NDX) closed 0.34% higher.

Retail sentiment around the S&P 500 ETF on Stocktwits was in the ‘extremely bearish’ territory at the time of writing.

The iShares U.S. Technology ETF (IYW) ended the day up 0.40%, while the iShares Expanded Tech Sector ETF (IGM) closed up by 0.03%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_supermicro_resized_jpg_95d12828d5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_UWM_resized_f22f7e06b8.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2229918735_jpg_e905cbd5e3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1445160636_jpg_9759816169.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250240977_jpg_5b777d96ef.webp)