Advertisement|Remove ads.

General Mills Stock Dips After Q3 Sales Decline Amid Slowdown In Snacking: Retail Sentiment Sours

Shares of General Mills Inc. fell more than 2% on Wednesday following worse-than-expected fiscal third-quarter sales from the consumer products giant, dragging down retail sentiment.

General Mills’s Q3 adjusted EPS came in at $1.00, slightly above the consensus of $0.96. Its Q3 revenue came in at $4.84B, below the consensus of $4.95 billion.

"Our third-quarter organic net sales finished below our expectations, driven largely by greater-than-expected retailer inventory headwinds and a slowdown in snacking categories," said CEO Jeff Harmening.

"At the same time, we drove continued positive market share trends in ‘Pet’, ‘Foodservice,’ and ‘International’ as well as improvement in Pillsbury refrigerated dough and Totino's hot snacks, two businesses where we made incremental investments last quarter and saw positive returns."

General Mills management also warned about the macroeconomic uncertainty impacting its upcoming quarter where it plans to invest in new products, media support, and in-store visibility.

General Mills sees fiscal 2025 adjusted EPS to decline 7%-8% and organic net sales to go down 1.5%-2%. The guidance didn’t include any specifics on tariff impact.

"We're focused on improving our sales growth in fiscal 2026 by stepping up our investment in innovation, brand communication, and value for consumers," Harmening continued. “We’ll fund that investment with another year of industry-leading HMM productivity, coupled with expected new cost-savings initiatives designed to further boost our efficiency and enable growth.”

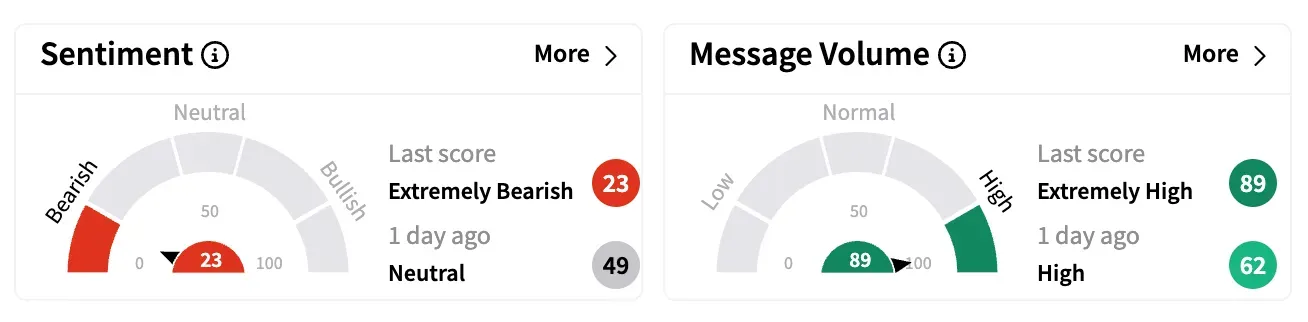

Sentiment on Stocktwits turned ‘extremely bearish’ from ‘neutral’ a day ago. Message volume climbed to extremely high from high.

One bearish watcher called it “game over” for junk food referring to the GLP-1 trend.

Another wondered if American consumers had stopped snacking, noting a decline in obesity rates and indicating going long on GLP-1.

General Mills’ stock is down 7% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Sarepta_Therapeutics_jpg_6cce13dbca.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_conocophillips_resized_98da51d9b9.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2239226376_jpg_c72fd10c8b.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_App_Lovin_jpg_42d40549b1.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_US_economy_representative_image_jpg_88c3aa4736.webp)