Advertisement|Remove ads.

General Motors Stock Climbs After Earnings Beat, Raised Guidance: Retail Sentiment Still Bearish

General Motors Company ($GM) shares rose 1% in pre-market trading on Tuesday after the automaker exceeded third-quarter earnings expectations and raised its full-year guidance.

For the July to September quarter, GM posted earnings per share (EPS) of $2.96, well above the expected $2.38. Its revenue surged by over 10% to $48.8 billion, surpassing Wall Street’s estimates of $44.67 billion, and outpacing the 5% increase in vehicle sales.

This indicates that GM has been selling its cars at higher average prices this year compared to 2023. The company also reported delivering more vehicles than any other automaker in the U.S. during the quarter.

In addition to beating earnings, GM raised its profit forecast for the third time this year. The company now projects adjusted earnings before interest and taxes (EBIT) to range from $14 billion to $15 billion, an increase from the prior guidance of $13.0 billion to $15.0 billion. GM also adjusted its earnings per share outlook to between $10.00 and $10.50, up from the earlier range of $9.50 to $10.50.

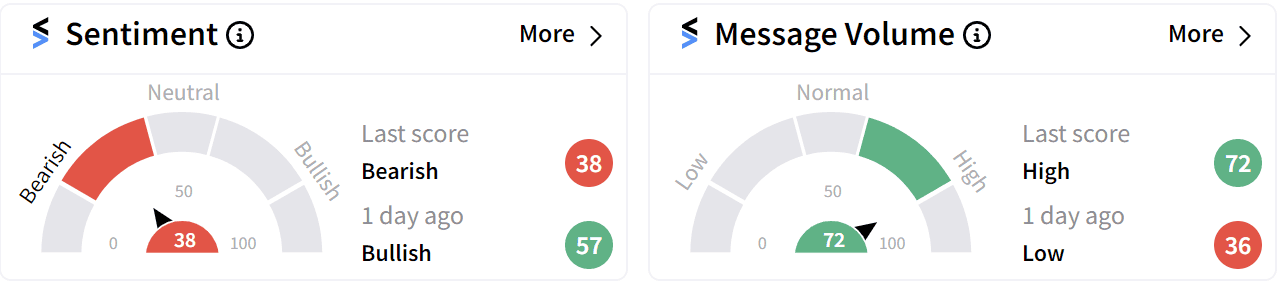

Despite GM's strong financial performance, retail sentiment on Stocktwits remained ‘bearish’ (38/100) heading into Tuesday's trading session.

“Competition is fierce, and the regulatory environment will keep getting tougher. That’s why we are focused on optimizing our ICE margins and working to make our EVs profitable on an EBIT basis as quickly as possible,” GM CEO Mary Barra stated in her letter to shareholders.

GM managed to cut EV losses during the third quarter, addressing a key concern for investors. While sales of the Bolt EV dropped, other EV models compensated, with total electric vehicle sales reaching 32,195 units, a 60% increase compared to last year. Pickups and full-size SUVs led overall sales.

At GM's recent investor day, CFO Paul Jacobson reaffirmed that the company remains committed to achieving profitability on its electric vehicles by 2025, even after lowering its 2024 production target to 200,000 units from the previous range of 200,000 to 250,000. GM expects to reduce EV costs by $2 billion to $4 billion by that time.

GM’s stock has gained 36% so far in 2024, and 68% in the last 12 months.

For updates and corrections email newsroom@stocktwits.com

Read More: Cigna Dips, Humana Rises Amid Revived Merger Discussions: Retail Sentiment Divided

/filters:format(webp)https://news.stocktwits-cdn.com/large_ras_tanura_jpg_b79d6fe085.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2202580632_jpg_9b97227b1a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ACHR_resized_jpg_25097dbec7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Plug_resized_jpg_82cf2f0bcd.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/astspacemobile_resized_jpg_8a6aa92413.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2231279747_jpg_9150b71435.webp)