Advertisement|Remove ads.

GNS Stock Soars Overnight After Over 16 Million 'Lost' Shares Enter Bitcoin Loyalty Lockup

- Genius Group said 16.7 million shares have been verified and added to the Bitcoin Loyalty Program.

- Eligible shareholders will receive a $0.10-per-share Bitcoin bonus, with withdrawals open through May 28.

- GNS stock climbed more than 12% overnight after gaining 8.5% on Friday.

Shares of Genius Group (GNS) outperformed other Bitcoin (BTC)-linked equities on Monday night, after the company moved to resolve a lingering issue tied to its 2023 spin-off.

A broker glitch left 20.4 million GNS shares, which accounted for nearly 41% of a 50-million-share batch, unaccounted for. On Friday, the company initiated a new share count aimed at identifying shareholders and reconciling the records.

The company said it verified 16.7 million shares, adding them to its Bitcoin Loyalty Program. This brings total participation in the program from 2.3 million to 19 million shares. It added that eligible holders would receive a $0.10-per-share Bitcoin bonus and could withdraw their allocation through May 28.

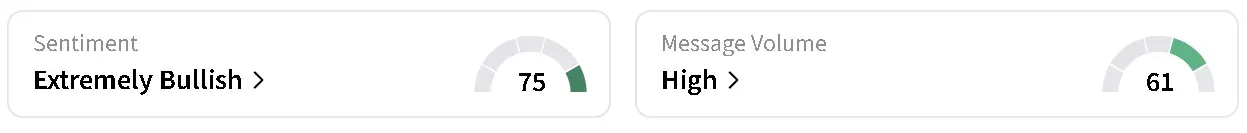

GNS’ stock rose 12.75% in overnight trade after a jump of 8.5% on Friday. Retail sentiment around the Bitcoin-focused digital asset treasury (DAT) remained in ‘extremely bullish’ territory amid ‘high’ levels of chatter over the past day.

Users on the platform are anticipating a bigger move in the coming week.

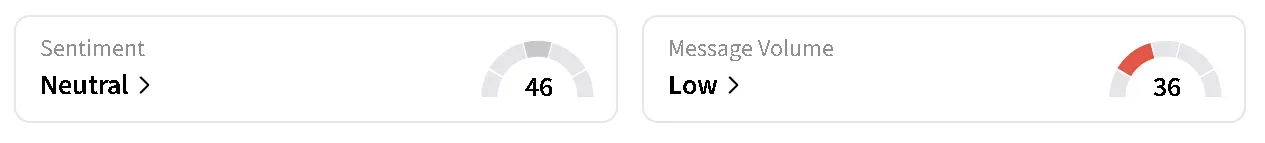

The move comes as Bitcoin’s price attempted to break past the $70,000 barrier during the session but fell back to around $68,400 by Monday night, trading flat, as per CoinGecko data. On Stocktwits, retail sentiment around the apex cryptocurrency rose to ‘neutral’ from ‘bearish’ territory over the past day while chatter remained at ‘low’ levels.

Genius Group’s stock has fallen more than 30% this year and is down 10% over the past 12 months.

Read also: Crypto Market Waits On CPI Report With Bitcoin, Ethereum Under Threat Of Deeper Correction

For updates and corrections, email newsroom[at]stocktwits[dot]com.btc

/filters:format(webp)https://news.stocktwits-cdn.com/large_bmnr_OG_jpg_83d4f3cc27.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_us_iran_jpg_753ef9f5af.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_capitol_market_OG_jpg_8111684a8f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2222519332_jpg_15709268a8.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Plug_Power_jpg_08143c7fa0.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_stablecoin_rep_jpg_5ec196dfc2.webp)