Advertisement|Remove ads.

Gold Hits Fresh All-Time Highs As US-China Trade Tensions Spike

Gold prices hit another record high on Monday as renewed trade tensions between the U.S. and China brought in safe-haven flows into bullion.

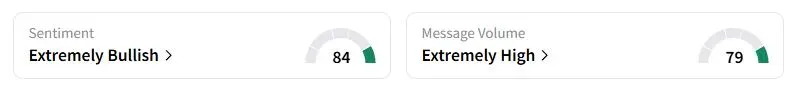

Spot gold prices rose 1.4% to $4,073.26 per ounce at 3.44 a.m. ET. It had jumped as high as $4,078.18 per ounce earlier in the session. The bullion has already posted eight consecutive weeks of gains. Retail sentiment on Stocktwits about the SPDR Gold Shares ETF (GLD) was in the ‘extremely bullish’ territory.

The spike came after U.S. President Donald Trump said that the U.S. would impose 100% tariffs on China in response to Beijing’s rare earth export curbs. The concerns around another trade war led to a sharp $2 trillion sell-off on Friday alongside the largest crypto liquidation in history, with over $19 billion worth of leveraged positions erased in just 24 hours.

Non-yielding bullion tends to gain during geopolitical uncertainties as investors park their money in safe-haven assets such as precious metals.

One bullish user expected the GLD, the biggest gold-backed ETF, to hit an all-time high.

However, over the weekend, both sides tried to ease the tensions. China’s Ministry of Commerce signaled that it was open to discussing the rare earth export curbs and other issues with the U.S., while Trump also indicated that he believes the two sides can resolve the dispute.

Separately, the U.S. Congress shutdown continued to delay the release of key economic data. The U.S. consumer price index report, initially scheduled for Wednesday, has been postponed to Oct. 24 as thousands of federal workers remain at home. However, the inflation report is expected to arrive before the Federal Reserve’s next policymaker meeting later this month.

Several Federal Reserve officials, including Fed Chair Jerome Powell, are scheduled to speak this week, which could offer insight into what the bankers are thinking regarding inflation, trade disputes, and the U.S. shutdown.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_WU_Western_Union_dc673aaa7c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Stock_market_Image_public_domain_declining_wc_96197f57d2.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2149589805_jpg_ceec7778b8.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Oil_drill_06147e8349.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Coinbase_c429427aa1.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Ford_jpg_186fb0eaa9.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)