Advertisement|Remove ads.

Gold, Silver Prices Climb To Fresh Record Highs Amid Renewed Trade Tensions Between US, China

Gold and silver prices continued to surge to fresh record highs on Monday after President Donald Trump sparked fresh trade tensions between the U.S. and China, threatening a “massive” tariff hike on the latter.

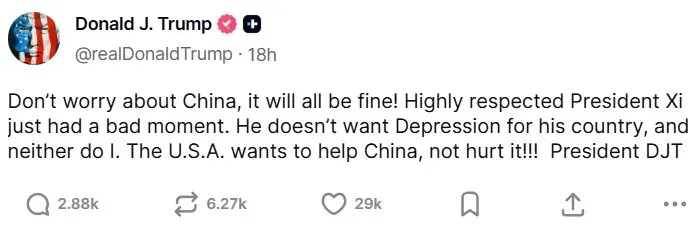

However, President Trump softened his stance in a subsequent post on Truth Social on Sunday. “Don’t worry about China, it will all be fine! Highly respected President Xi just had a bad moment. He doesn’t want Depression for his country, and neither do I. The U.S.A. wants to help China, not hurt it!!!” he said.

Spot gold prices climbed to a new high of $4,084 per troy ounce, surging by 1.7% before paring some of the gains. Gold futures maturing in December gained 2.1% to rise to $4,104.

Gold’s shine also rubbed off on silver, with spot silver prices climbing to a new high of $51.74 per troy ounce, rising nearly 2.9% over the previous day. Silver futures maturing in December soared by over 5% to $49.93.

Amid the ongoing surge in gold prices, Bank of America commodities analysts on Monday raised their price target on gold to $5,000 from $4,400 for 2026, according to a report by Reuters.

Gold and silver have been on a tear in 2025, with gold prices soaring by over 55% year-to-date, while silver prices have surged about 75%. “Silver and gold prices are typically intertwined because their main driver–private investment flows, whether through ETFs or speculative positioning-move in tandem,” analysts at Goldman Sachs said, according to a report by The Wall Street Journal.

Despite the surge in gold prices this year, Bridgewater Associates founder Ray Dalio recommended that investors increase the allocation for gold in their portfolios. “Gold is a very excellent diversifier in the portfolio. If you look at it just from a strategic asset allocation perspective, you would probably have something like 15% of your portfolio in gold … because it is one asset that does very well when the typical parts of the portfolio go down,” Dalio said last week at the Greenwich Economic Forum in Greenwich, Connecticut.

The SPDR Gold Shares ETF (GLD) was up 1.6% at the time of writing, while the iShares Gold Trust ETF (IAU) was up 1.62%. The GLD and IAU ETFs have both surged more than 52% year-to-date, with retail sentiment on Stocktwits around the two ETFs trending in the ‘extremely bullish’ territory.

The iShares Silver Trust ETF (SLV) was up 3.03% at the time of writing, while the abrdn Physical Silver Shares ETF (SIVR) was up 3.1%.

Also See: Dow Futures Surge After Trump Tempers China Tariff Threat: MP, NVDA, WBD, BABA Among Stocks To Watch

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_iren_OG_jpg_ba842dd11a.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2240705652_jpg_64172b74f3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trade_Desk_jpg_e7ed8e2266.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_wall_street_bull_OG_jpg_791f8f3b40.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2231786706_jpg_5f9940e890.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259293616_jpg_38a91a25a8.webp)