Advertisement|Remove ads.

Solaris Energy Infrastructure Stock Rallies Pre-market After Q4 Revenue Beats Street Estimates: Retail Stays Enthusiastic

Shares of Solaris Energy Infrastructure (SEI) rallied over 5% in Friday’s pre-market session after the company’s fourth-quarter revenue topped Wall Street estimates while earnings stood slightly below expectations.

Total revenue rose 52% year-over-year (YoY) to $96.29 million, beating an analyst estimate of $93.97 million. Earnings per share (EPS) came in at $0.12, marginally missing a Street estimate of $0.13.

Net income attributable to Class A common shareholders stood at $5.84 million compared to a net loss of $1.19 million in the same quarter a year ago.

CEO Bill Zartler said the company continues to see an acceleration of demand for behind-the-meter projects and has secured approximately 700 megawatts of new power generation capacity, which will effectively double its operated fleet over the next two years.

“This additional capacity will allow us both to service growth from our current customer base as well as to continue to expand our offering with new customers,” he said.

Zartler also highlighted that the Solaris Logistics Solutions segment has witnessed a strong rebound in activity early in 2025 relative to the seasonal softness experienced in the fourth quarter.

He said this is due to the continued market adoption of multiple types of Solaris systems on an increased number of well sites and a reset of completion budgets.

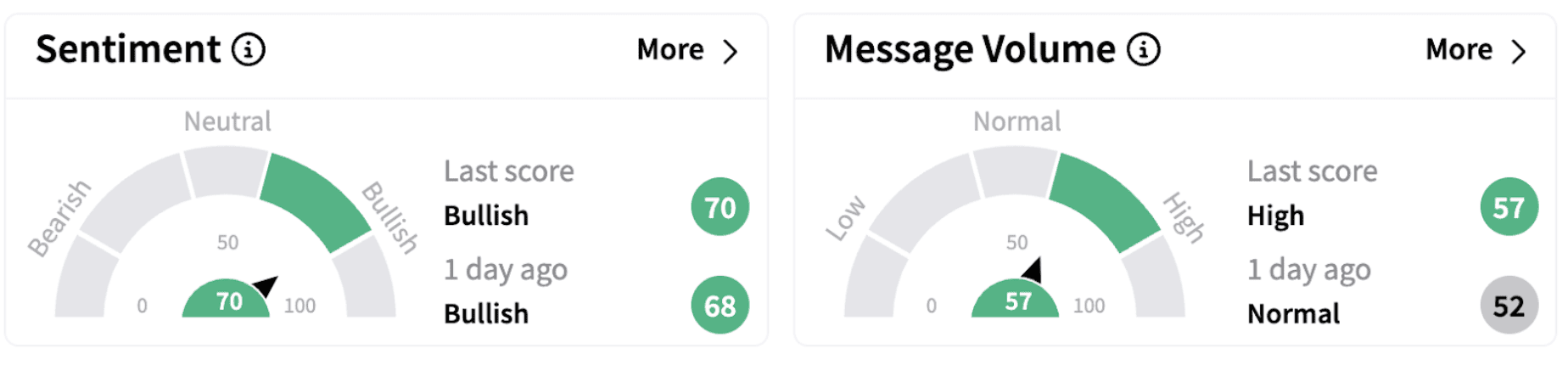

Retail sentiment on Stocktwits continued to trend in the ‘bullish’ territory (70/100) accompanied by ‘high’ retail chatter.

Solaris Energy expects first-quarter 2025 total adjusted earnings before interest, tax, depreciation, and amortization (EBITDA) to be between $44 and $48 million and second-quarter total adjusted EBITDA to be between $50 and $55 million.

Solar Energy shares have lost about 0.37% in 2025 but have gained over 277% over the past year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1247400381_jpg_765e6ec016.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Black_Rock_Bitcoin_ETF_IBIT_f66b744bfc.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_kraken_2091850a33.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_wall_street_resized1_jpg_7f200ce842.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2215666275_jpg_07d03239b9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_2026_2_jpg_a7bbca2bde.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)