Advertisement|Remove ads.

Grab Stock In Spotlight After Indonesia’s GoTo Replaces CEO Amid Merger Talks

- Earlier this month, Bloomberg News reported that several GoTo shareholders signed a memo to the board requesting an extraordinary general meeting to propose a vote on replacing Walujo as CEO.

- Any merger between the two firms could help the combined firm boost its margins, as they have resorted to aggressive discounts to gain market share.

- GoTo has lost nearly 40% of its valuation since Walujo took charge, who is also reportedly opposed to the Grab takeover.

Grab (GRAB) stock is expected to be in focus on Monday after the ride-hailing firm’s Indonesian rival, GoTo, said it would replace its CEO, Patrick Walujo, amid deal talks between the two firms.

GoTo Chief Operating Officer Hans Patuwo is slated to replace Walujo, the company said. The appointment, which needs to be approved by shareholders at a meeting on Dec. 17, is part of a “rigorous succession process” prepared by its board, reflecting the company’s commitment to “ensuring stability, strategic continuity, and operational excellence,” GoTo said.

Why Does It Matter To Grab?

Grab and GoTo have held talks on a potential merger several times, but they yielded little progress. However, takeover rumors have once again gathered steam after Indonesia’s government announced earlier this month that it is in talks with the two ride-hailing and delivery companies about a potential deal.

Earlier this month, Bloomberg News reported that several GoTo shareholders signed a memo to the board requesting an extraordinary general meeting to propose a vote on replacing Walujo as CEO. The company has lost nearly 40% of its valuation since Walujo took charge, who is also reportedly opposed to the Grab takeover.

Any merger between the two firms could help the combined firm boost its margins, as they have resorted to aggressive discounts to gain market share. While Uber, which holds a stake in Grab, exited the fiercely competitive Southeast Asian market, other smaller competitors are challenging the bigger players amid economic weakness in some economies.

What Are Stocktwits Users Thinking?

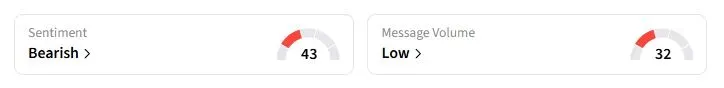

Retail sentiment on Stocktwits about Grab was in the ‘bearish’ territory at the time of writing.

Grab offers a wide range of services, including food deliveries, online ride booking, and banking. The company operates primarily in Southeast Asian countries, such as Indonesia, Singapore, Thailand, and Malaysia. The stock has gained 3.6% this year amid some concerns over a slowdown in consumer demand in its key markets.

Earlier this month, while the company's executives acknowledged that it is not immune to macroeconomic trends, they stated that the company has positioned itself to thrive even during economic downturns.

Also See: BHP Ends Pursuit Of Rival Anglo American — What Does It Mean For Teck Resources?

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_lantheus_jpg_e10c71c486.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_nio_battery_swap_jpg_de98f34bea.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_anthropic_OG_jpg_51bd14bc5d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2233516954_jpg_72241a7246.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Oil_tanker_resized_jpg_bb40d4bd7e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)