Advertisement|Remove ads.

Grasim Industries: SEBI RA Krishna Pathak Eyes Bullish Breakout Above ₹2,717

Grasim Industries delivered a mixed bag in its March quarter (Q4 FY15) earnings, combining strong revenue growth with concerns about profitability pressures.

SEBI-registered analyst Krishna Pathak notes that while Grasim’s revenue jumped 32% year-on-year to ₹8,926 crore, comfortably beating market estimates, the net loss of ₹288 crore — though narrower than last year’s ₹441 crore — was still wider than analyst expectations of ₹110 crore.

A silver lining came from a sharp reduction in exceptional items (₹114 crore vs ₹716 crore YoY), pointing to better cost control or fewer one-offs.

However, deeper concerns lie in the sharp 58% drop in EBITDA to ₹221 crore, missing the expected ₹358 crore.

The EBITDA margin contracted significantly to 2.5% from 7.8% in the same quarter last year, a sign of mounting cost pressures or operational inefficiencies.

Despite this, the board declared a final dividend of ₹10 per equity share, signaling some confidence in the company’s medium-term prospects.

From a technical analysis standpoint, Grasim appears to be in a range-bound consolidation, trading between support at ₹2,645 and resistance at ₹2,715.

Pathak views this as a potential base-building phase, with accumulation interest visible in the ₹2,633–₹2,643 zone based on volume spikes.

The 9-day Exponential Moving Average (EMA) at ₹2,717 is acting as a dynamic resistance level.

Pathak notes that a sustained break above this range could signal a bullish breakout, with upside targets for long-term investors at ₹2,939, ₹3,077, and ₹3,156.

However, he cautions that a breakdown below ₹2,535 would invalidate this bullish setup and could trigger further downside.

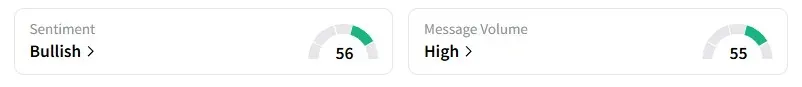

Meanwhile, retail sentiment on Stocktwits has shifted to ‘bullish’ from ‘neutral’ over the past week, suggesting growing optimism despite near-term headwinds.

Grasim shares have gained 10% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2218096416_jpg_9d469a2ec6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2229019640_jpg_c6006d7238.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_adam_smigielski_K5m_Pt_O_Nmp_HM_unsplash_f365ee93f4.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_jpg_fc59d30bbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1190665957_jpg_92088206ed.webp)