Advertisement|Remove ads.

GXAI Shares Surged More Than 45% Today — What’s The Amazon Connection?

- The deal will also engage cloud services company Caylent as a collaborator.

- Amazon Web Services will support the development of the real-time, AI sales platform, called Gaxos Labs.

- Gaxos Labs will incorporate live call transcription, automated coaching intelligence, and post-call analytics.

Shares of artificial intelligence company Gaxos.AI Inc. (GXAI) rallied over 45% on Tuesday after the company announced that Amazon.com Inc.’s (AMZN) Web Services has committed to funding the preliminary development of its AI-powered sales coaching platform.

The deal will also engage cloud services company Caylent as a collaborator, according to the company.

Gaxos.AI provides AI solutions across health, wellness, and gaming sectors.

Deal Details

Amazon Web Services will support the development of the real-time, AI sales platform, called Gaxos Labs. The platform, designed for enterprise-scale deployment, will incorporate live call transcription, automated coaching intelligence, and post-call analytics. Built as a full AWS-native infrastructure, Gaxos Labs will enable rapid scalability, low-latency, and commercial readiness.

The micro-cap company said the deal will help with consolidating and prototyping core platform capabilities and proprietary frameworks to support advanced workloads. It will emphasize scalable infrastructure design, security, governance controls, and operational efficiency, while reducing reliance on external providers.

Gaxos added that it expects Amazon’s support in the development phase to enhance credibility, support future opportunities for revenue generation, and also provide possibilities for other strategic partnerships.

“AWS funding our platform development is a major validation event for Gaxos,” said Vadim Mats, CEO of Gaxos. “This collaboration materially advances our roadmap and enhances our ability to pursue large-scale commercial opportunities.”

How Did Stocktwits Users React?

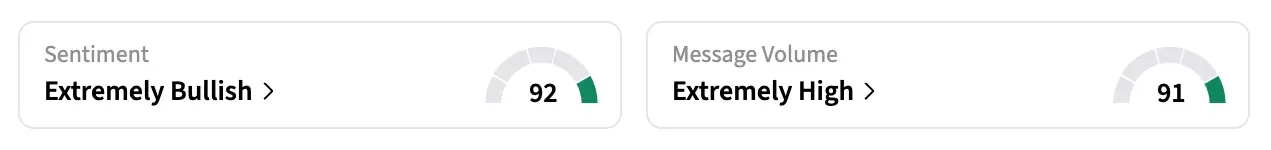

On Stocktwits, retail sentiment around GXAI shares surged from ‘bearish’ to ‘extremely bullish’ over the past 24 hours.

Meanwhile, message volumes jumped from ‘high’ to ‘extremely high’ levels.

Retail users cheered the Amazon collaboration, with one bullish user saying the deal was ‘too good.’

Another bullish user gave the company a price target of $5-$10, saying it was more a question of timing.

Shares of GXAI have surged over 77% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Also Read: What Is Weighing PayPal Down? Gary Black Points To This Limitation

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2230137825_jpg_d14459f501.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_brian_armstrong_OG_jpg_3ac8291bf2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2227994915_jpg_357c625963.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_paramount_skydance_warner_bros_discovery_jpg_709742214d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2258839311_jpg_35f0914ce1.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2238737789_jpg_eca1ed4bd9.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)