Advertisement|Remove ads.

What Is Weighing PayPal Down? Gary Black Points To This Limitation

- In an earlier post, Black said that the fintech company remains one of his “least-liked” online payments providers “despite strong megatrends favoring digital payment platforms.”

- His comments come after the company reported weak fourth-quarter (Q4) results that missed Wall Street expectations.

- PayPal reported Q4 revenue of $8.68 billion, falling short of analyst expectations of $8.79 billion, according to Stocktwits data.

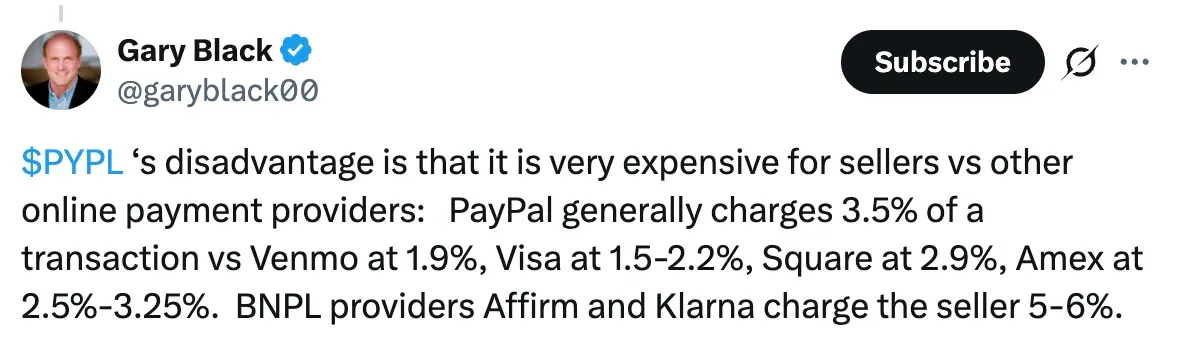

Gary Black, managing partner of Future Fund, provided his insights into why he thinks PayPal Holdings Inc. (PYPL) is disadvantaged compared to its peers.

PayPal’s limitation is that “it is very expensive for sellers vs other online payment providers,” Black said in a post on X on Tuesday.

His comments come amid the stock’s steep decline after it posted weak fourth-quarter (Q4) results that missed Wall Street expectations.

Shares of PYPL have plummeted over 20% on Tuesday at the time of writing.

The Cost Disadvantage

To illustrate his point, Black compared PayPal’s charges to other online payment providers. “PayPal generally charges 3.5% of a transaction vs Venmo at 1.9%, Visa at 1.5-2.2%, Square at 2.9%, Amex at 2.5%-3.25%. BNPL providers Affirm and Klarna charge the seller 5-6%,” he noted.

In an earlier post, Black said that the fintech company remains one of his “least-liked” online payments providers “despite strong megatrends favoring digital payment platforms.”

He highlighted the company’s weak quarterly results and new CEO appointment in the post.

PayPal’s Q4 Results

Earlier on Tuesday, PayPal reported a 4% year-on-year growth in Q4 revenues, coming in at $8.68 billion, but falling short of analyst expectations of $8.79 billion, according to Stocktwits data.

The company missed expectations on earnings as well, reporting adjusted earnings per share (EPS) of $1.23 versus expectations of $1.29, as per Stocktwits data.

PayPal also announced a new CEO, appointing Enrique Lores to lead the company from March 1, 2026, who would replace current CEO Alex Chriss.

Meanwhile, the company provided earnings guidance for the next quarter below street consensus. PayPal said that it expects adjusted EPS of $1.33 in the first-quarter (Q1) of 2026, falling short of estimates that expected $1.38, according to Koyfin data.

How Did Stocktwits Users React?

Meanwhile, on Stocktwits, retail sentiment around PYPL shares remained in the ‘extremely bullish’ territory over the past 24 hours amid ‘extremely high’ message volumes.

PYPL stock has lost over 53% of its value in the past year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Also Read: Microsoft Slid Nearly 13% In The Past Month — So Why Is It Piper Sandler’s Top Pick?

/filters:format(webp)https://news.stocktwits-cdn.com/large_tesla_fsd_jpg_f113fd1ea5.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2212147411_jpg_a8bf4473f2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2230137825_jpg_d14459f501.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_brian_armstrong_OG_jpg_3ac8291bf2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2227994915_jpg_357c625963.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_paramount_skydance_warner_bros_discovery_jpg_709742214d.webp)