Advertisement|Remove ads.

Hertz Is Back From The Brink: Ackman’s Backing, Balance-Sheet Repair And An Autonomy Wild Card Force Traders To Watch Closely

- Hertz shares jumped on Monday after investor Bill Ackman reshared a bullish take on the company.

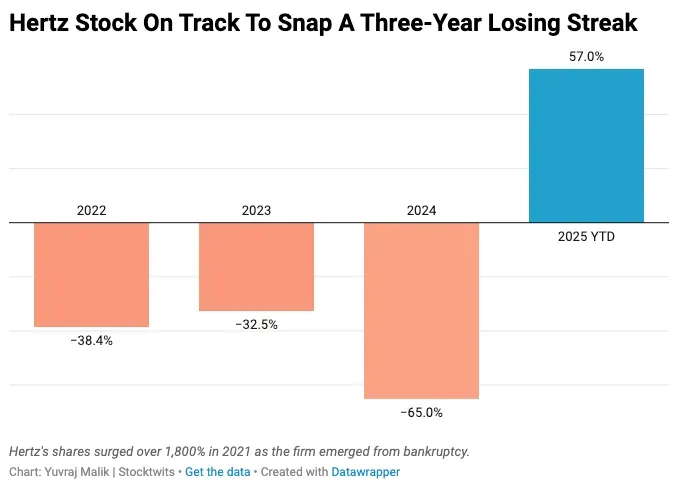

- The stock is on track to snap a three-year streak in the red.

- HTZ rallied in April after Ackman’s Pershing Square disclosed that it had built up a significant stake in the company.

Hertz Global Holdings, Inc. got a late-year lift on Monday from investor Bill Ackman, capping what has been a turnaround year for one of the world’s largest car-rental companies that went bankrupt five years ago.

Hertz’s shares jumped 11.5% – and continued their rise into Tuesday – after Ackman reshared a detailed analysis on X about the company potentially being undervalued infrastructure for robotaxis and robotics, similar to data center operators in the AI boom.

Hertz-Robotaxi Case

The X blog from Cassian, a self-described tech founder building a “convex portfolio”, argued that Hertz could become the “picks-and-shovels” infrastructure play for robotaxis and robotics – much like data-center operators did in the AI boom – by running the unglamorous but critical fleet layer.

With expertise in fleet ownership, financing, maintenance, insurance, and high-utilization operations, Hertz may be structurally positioned for autonomy at scale, even if that optionality isn’t priced in today, the blog notes. To which Ackman said, “Interesting read on @Hertz.”

With Thursday’s rally, Hertz stock has gained nearly 60% year to date and is firmly on track to finish in the green after three years of decline following its relisting in 2021 (see chart).

Ackman has had a significant role to play: the activist investor and founder of hedge fund, Pershing Square Capital Management, built up a sizable stake in the company in April, leading to an over 50% rally in the stock at the time.

CNBC reported at the time that Pershing Square had amassed a nearly 20% stake, making it the second-largest shareholder in the company, significantly higher than the 4.1% stake the hedge fund disclosed in its securities filing.

2025 Turnaround

Ackman’s involvement aside, Hertz’s momentum is also a result of changes and operational improvements over the past two years. Last year, the company disposed of electric vehicles from its fleet, including its Teslas, because they were more expensive to maintain and operate than gasoline vehicles.

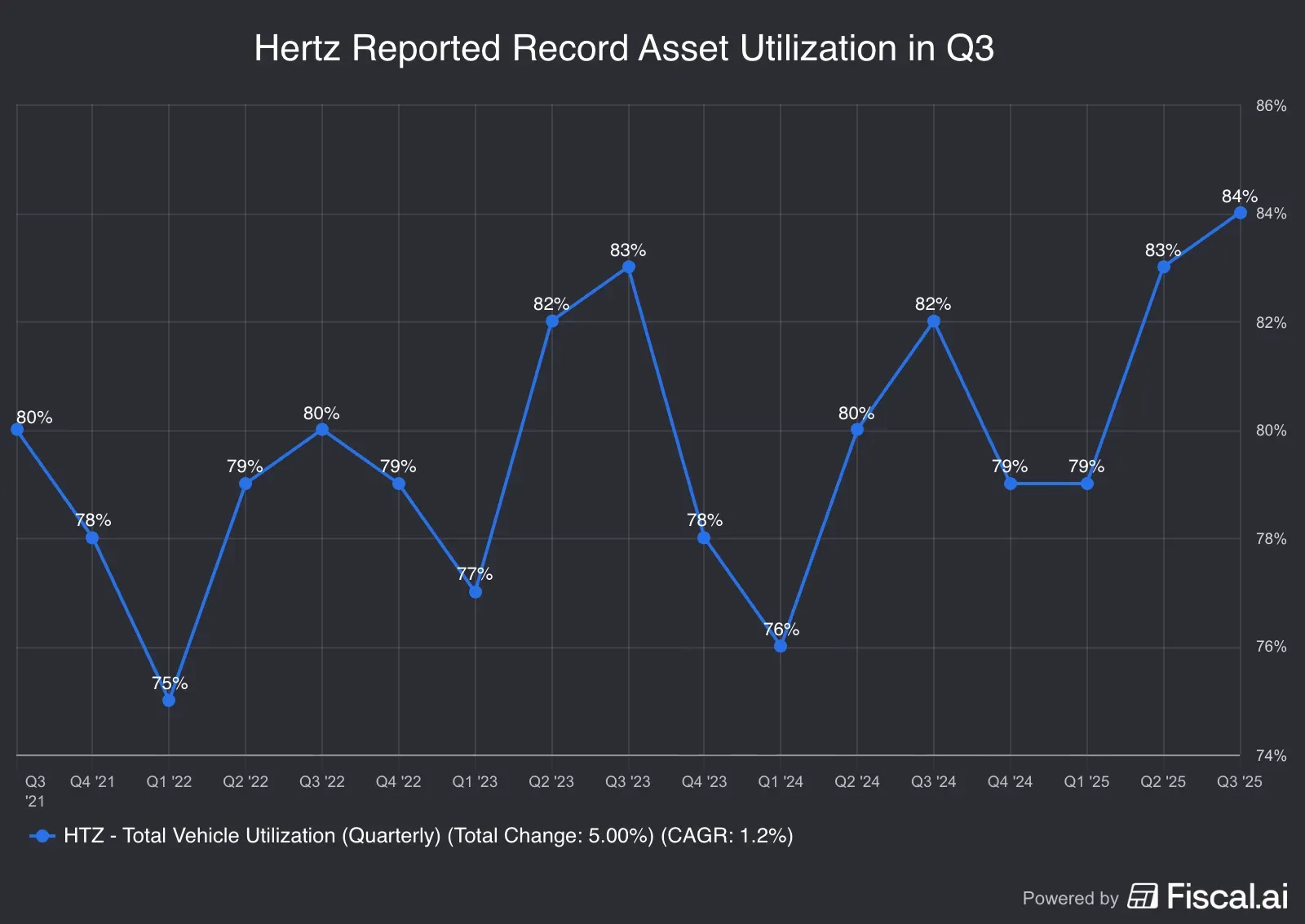

In 2025, the company pushed to refresh its fleet, replacing older or high-depreciation vehicles with newer models — a move that lowered costs and improved utilization — and expanded its used-car sales business by shifting the entire process online through its HertzCarSales.com platform.

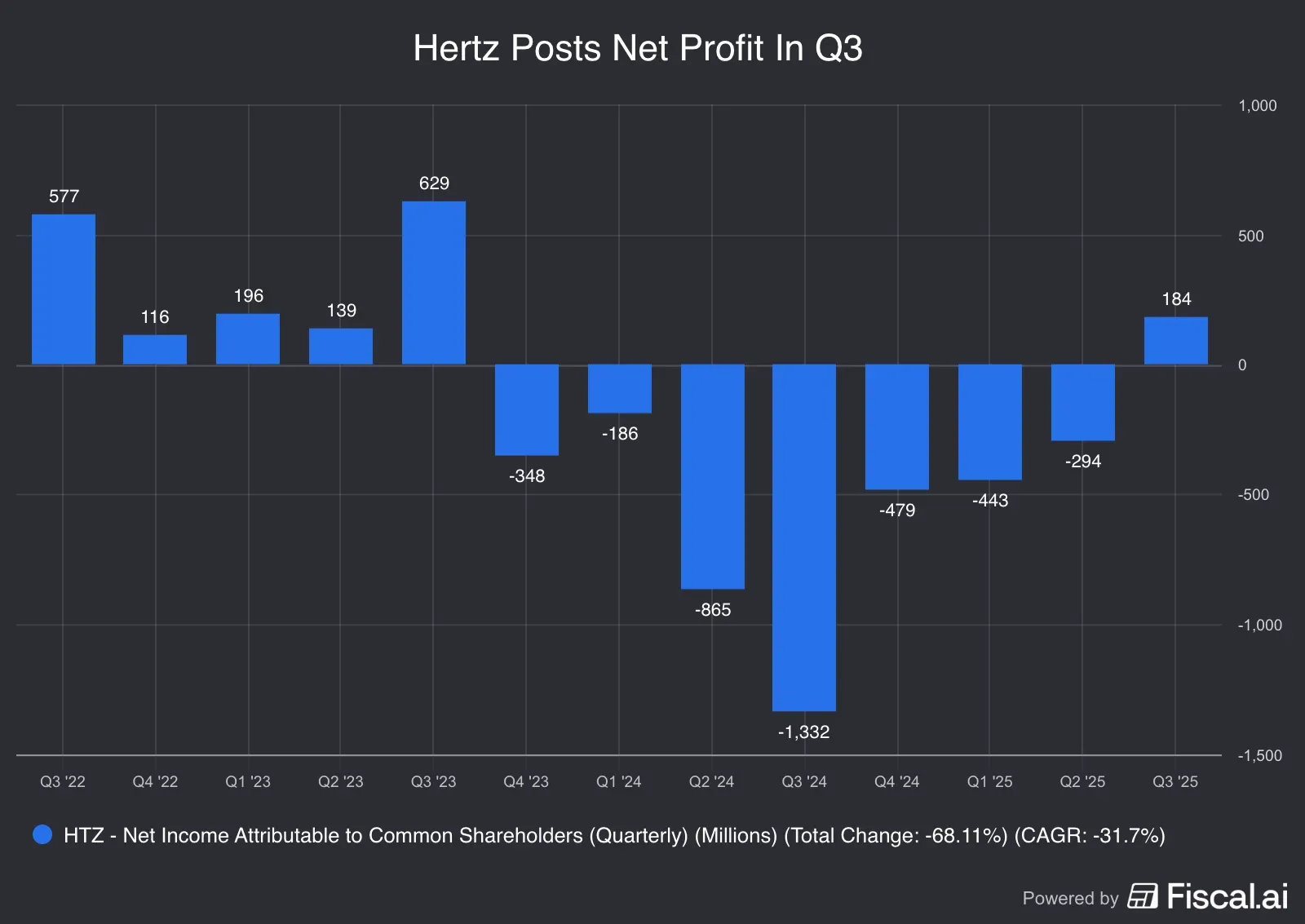

In the third quarter, Hertz reported positive net income for the first time in two years and posted a record 84% asset utilization.

On Stocktwits, HTZ stock has seen frequent swings between ‘bullish’ and ‘bearish’ sentiment readings over the year, settling on ‘Neutral’ as of early Tuesday. Its watcher count has increased by over 87% and its message volume by 1,650% so far in 2025, indicating strong retail interest as the company navigates out of a rough patch.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read Next: OpenAI’s Damning Year Of Legal Battles Exposes Cost Of Moving Fast In AI Gold Rush

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_140648412_jpg_05552b4117.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_912727778_jpg_3bd44c57ad.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1235943608_jpg_91702ef0ab.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_167578473_jpg_29255f031f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Michael_Burry_jpg_fa0de6ac92.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_winklevoss_1c7de389e0.webp)