Advertisement|Remove ads.

Hims & Hers Health Stock Jumps After-Hours As Q3 Growth, Novo Nordisk Talks Fuel Bullish Retail Bets

- Revenue rose 49% year-over-year to nearly $600 million, while net income reached $15.8 million and adjusted EBITDA climbed 53% to $78.4 million.

- Subscriber count grew 21% to almost 2.5 million, with monthly online revenue per subscriber up 19% to $80.

- On Stocktwits, retail sentiment was ‘extremely bullish,’ with users predicting the stock could climb toward $50 once Novo Nordisk partnership talks conclude.

Shares of Hims & Hers Health rose about 5% in after-hours trading on Monday after the company reported another quarter of strong growth and said it’s in talks with Novo Nordisk to bring weight-loss drug Wegovy to its platform.

Revenue And Subscriber Growth Remain Strong

Revenue rose 49% from a year earlier to $599 million as strength continued across the company’s weight-loss and wellness businesses. Net income was $15.8 million, versus $75.6 million a year ago, which had reflected a one-time tax benefit. Adjusted EBITDA increased 53% to $78.4 million.

Hims & Hers now has nearly 2.5 million subscribers, up 21% from a year earlier, and monthly revenue per subscriber has also risen 19% to $80. Cash from operations soared to $149 million, while free cash flow for the quarter remained stable at $79 million.

Gross margin fell to 74%, from 79% a year earlier, mainly due to changes in shipping cadence and higher production costs related to Hims & Hers’ growing weight-loss portfolio.

Talks With Novo Nordisk

The company said it’s in active talks with Novo Nordisk to make Wegovy injections and an eventual oral formulation available on its platform once they have prescribing approval. No agreement has been reached, and the company said that a deal is not guaranteed.

The company said during the earnings call that it expects to bring in over $725 million in weight-loss revenue this year, and that it’s spending money to build new sterile compounding and fulfillment centers to keep up with the surge in demand.

Outlook For 2025

Hims & Hers narrowed its 2025 revenue forecast to a range of $2.335 billion to $2.355 billion, slightly above its previous estimate of $2.3 billion to $2.4 billion. It now expects adjusted EBITDA between $307 million and $317 million, compared with the earlier range of $295 million to $335 million.

For the fourth quarter, the company expects revenue of $605 million to $625 million and adjusted EBITDA of $55 million to $65 million. The company said near-term margins will be affected by ongoing investments in its compounding operations and by price adjustments to GLP-1 drugs, though it expects conditions to improve next year as volumes continue to rise.

Stocktwits Traders Bet On Further Gains

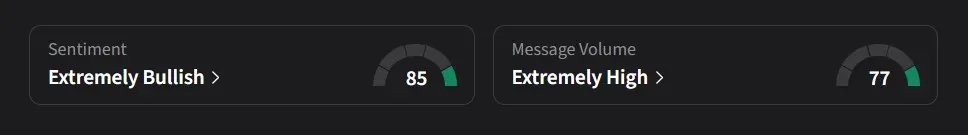

On Stocktwits, retail sentiment for Hims was ‘extremely bullish’ amid a 1,734% surge in 24-hour message volume.

One user said they viewed the stock as a solid buy for the next move higher, expecting it to stay above the $30 range.

Another predicted that shares could climb toward $50 following the company’s strong results and new initiatives. Meanwhile, a third user said the stock could rally sharply once its ongoing discussions with Novo Nordisk are concluded.

Hims & Hers Health’s stock has risen 84% so far in 2025.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233918556_jpg_1c5248e175.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227669377_jpg_9a115c3623.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227231004_jpg_0de480c6f4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2254924041_jpg_892ccf911d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1234736300_jpg_881ee00045.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2218899763_jpg_5d8b51f97d.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)