Advertisement|Remove ads.

Hims & Hers Soars Pre-Market After Analysts Boost Price Targets On Strong Q3 Performance

Hims & Hers Health Inc. ($HIMS) rallied nearly 9% in pre-market trading on Tuesday, following the company’s third-quarter earnings report that outperformed expectations, released after Monday’s market close.

The company reported earnings per share (EPS) of $0.32, significantly surpassing Wall Street's estimate of $0.10.

Its third-quarter revenue reached $401.6 million, exceeding the expected $382.2 million and marking a 77% increase from the same quarter last year.

Hims & Hers also raised its full-year sales guidance to $1.46 billion to $1.465 billion, up from a forecast in August for $1.37 billion to $1.4 billion.

On Tuesday, Canaccord raised its price target for Hims & Hers to $28 from $24 while maintaining a ‘Buy’ rating.

Piper Sandler has also raised its price target on Hims & Hers Health stock to $21 from $18 while maintaining a ‘Neutral’ rating. The brokerage noted the company’s strong sales performance but highlighted a year-on-year decline in gross margins.

It attributed the decrease to challenges in the product mix of GLP-1 medications and competitive pricing pressures affecting core subscribers.

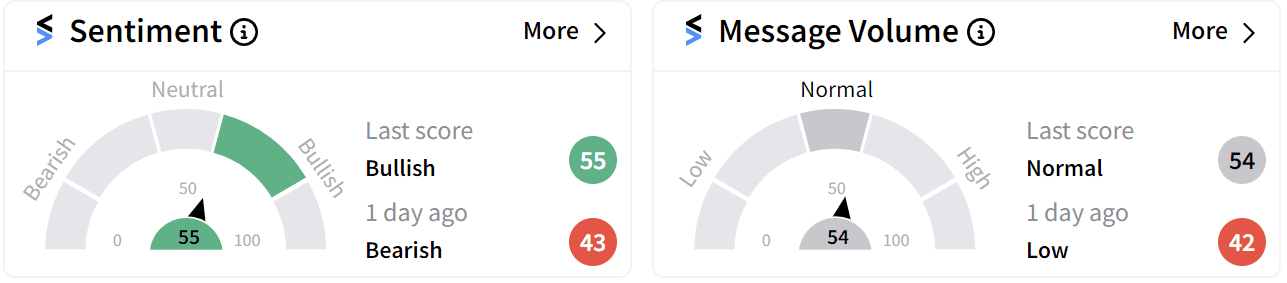

Retail sentiment on Stocktwits was ‘bullish’ (55/100) as markets closed on Monday, reflecting positive investor sentiment ahead of the earnings report.

Hims & Hers launched GLP-1 drugs earlier this year in May, following U.S. regulators' approval for compounded versions to address market shortages.

While these medications are primarily intended for other health conditions, they have gained popularity among individuals seeking weight loss solutions.

In a letter to shareholders on Monday, it will add Liraglutide to its inventory in 2025. Liraglutide, used to treat type 2 diabetes under the brand name Victoza, belongs to the first generation of drugs known as GLP-1 agonists, which curb appetite and help control blood sugar.

Although there is potential for better profit margins as the business grows, Piper is cautious about future margins due to ongoing challenges with GLP-1 products and necessary investments for new launches.

The stock has more than doubled in value this year, gaining 133% so far in 2024.

For updates and corrections email newsroom@stocktwits.com.

Read more: Hims & Hers Stock Up Ahead of Earnings: Retail Sentiment Upbeat

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_US_stocks_3e2253bcca.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Revised_Profile_JPG_0e0afdf5e2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Service_Now_logo_jpg_c0da5348e8.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_tesla_jpg_dcfe443bb4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_doordash_jpg_6a0ffd4b33.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_eric_trump_OG_jpg_19bc149869.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_opendoor_OG_jpg_55300f4def.webp)