Advertisement|Remove ads.

HIMS Stock Plunges 8 Straight Days: Is The GLP-1 Fallout Already Priced In?

- The three-day rout was driven by Novo Nordisk’s lawsuit and an FDA crackdown on compounded GLP-1 drugs.

- Deutsche Bank and Canaccord cut price targets on HIMS but pointed to 70%–80% upside from current levels.

- Canaccord said the selloff has already stripped out much of the value tied to compounded semaglutide sales.

Shares of Hims & Hers Health, Inc. (HIMS) are drawing renewed scrutiny after a brutal three-day selloff tied to regulatory pressure and legal action around compounded GLP-1 drugs, with at least one Wall Street firm arguing that much of the downside risk may now be reflected in the stock.

HIMS stock fell 11% on Tuesday, extending its losing streak to an eighth straight session, as the FDA crackdown and Novo Nordisk’s lawsuit accelerated an already ongoing selloff.

Wall Street Sees Legal Risk Largely Priced In

Deutsche Bank lowered the price target on Hims & Hers to $31 from $42, implying an upside of about 80% from the stock’s last close, while reiterating a ‘Hold’ rating. The brokerage said Hims is “under siege” following the abrupt reversal of its GLP-1 pill launch.

Canaccord was slightly more optimistic. The firm lowered its price target to $30 from $68, implying roughly 74% upside from current levels, while maintaining a ‘Buy’ rating. Canaccord said Novo Nordisk’s lawsuit adds “another layer of operational uncertainty,” but argued that the three-day share selloff has “implicitly removed” most of the value tied to compounded semaglutide sales. As a result, the firm believes a significant portion of the legal risk may already be priced into the stock.

FDA Crackdown And Novo Lawsuit Hit Hims GLP-1 Push

Novo Nordisk said on Monday it has filed a lawsuit seeking a permanent ban on Hims’ sales of compounded semaglutide products, alleging patent infringement and unlawful mass marketing of unapproved versions of Wegovy and Ozempic.

“Hims & Hers is mass marketing unapproved knock-off versions of Wegovy and Ozempic that evade the FDA’s gold-standard review process,” said Novo Nordisk senior vice president and general counsel John F. Kuckelman, calling the practice “dangerous and deceptive.”

The legal action followed a warning from the U.S. Food and Drug Administration, which said it would crack down on GLP-1 active pharmaceutical ingredients used in non-approved compounded drugs. The FDA said it may restrict access to such ingredients and refer violations to the Department of Justice, citing safety and quality concerns.

In response, Hims said it would stop offering its $49 compounded semaglutide pill just days after launching the product, saying it had held “constructive conversations” with industry stakeholders.

Wall Street View On HIMS Downside Scenarios

Earlier this week, Citi cut its price target on Hims & Hers to $16.50 from $30 and maintained a ‘Sell’ rating, warning that the company’s GLP-1 strategy was “risky and aggressive.” Citi said its target reflects a 25% probability of Hims losing all weight-loss drug sales, a 60% base-case scenario of losing half of those sales, and only a 15% bull-case outcome with limited GLP-1 downside.

Bank of America Securities also trimmed its target to $21 from $26 and reiterated an ‘Underperform’ rating. The firm noted that the FDA did not distinguish between oral and injectable GLP-1 products in its warning, raising the risk that regulatory scrutiny could extend to Hims’ injectable semaglutide offerings.

How Did Stocktwits Users React?

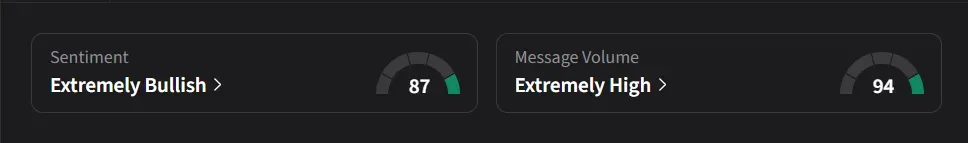

On Stocktwits, retail sentiment for HIMS was ‘extremely bullish’ amid ‘extremely high’ message volume.

One user said, “may be it will take couple of years to go $60 again . It did 5 times last year but this time its different. This needs time.”

Another user said that, with earnings approaching on Feb. 23, the stock could see a rebound. They added that “stock is already on lowest bottom u can imagine , load the boat before its too late”

HIMS stock has declined 61% over the past 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_moderna_covid_jpg_3eb7363e71.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_crowdstrike_resized_jpg_6549f7641a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2234227546_jpg_b7fa546ca4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_digitalpayments_resized_png_5e564e753b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2208385583_jpg_9511ec9642.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2229273911_jpg_6b4851e2cc.webp)