Advertisement|Remove ads.

HIMS Stock In Turmoil: Retail Bulls Bet On Rebound, Skeptics See Bloodbath After Compounded Weight-Loss Pill Halt

- The company halted sales of a compounded Wegovy copy following FDA scrutiny.

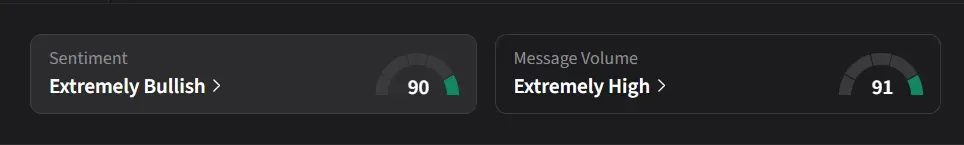

- Retail sentiment remained 'extremely bullish' despite a year-to-date decline.

- The FDA said it planned to restrict access to GLP-1 ingredients used in compounded drugs and refer Hims to the Department of Justice.

Shares of Hims & Hers Health (HIMS) are likely to draw increased attention in the fresh trading week after the company said it would stop offering a compounded version of Novo Nordisk’s Wegovy weight-loss pill following regulatory scrutiny and threats of legal action.

HIMS stock is trading at its lowest level in more than 14 months and is down about 30% since the start of the year. Despite the decline, retail sentiment around the stock has remained optimistic.

FDA Action Forces Abrupt Reversal

Hims said on Saturday that it would pull the $49 compounded semaglutide pill from its platform just days after the telehealth company announced plans to offer a lower-priced alternative to Novo Nordisk’s Wegovy.

“Since launching the compounded semaglutide pill on our platform, we’ve had constructive conversations with stakeholders across the industry,” the company said on X. “As a result, we have decided to stop offering access to this treatment.”

The move followed an announcement from the U.S. Food and Drug Administration (FDA) on Friday that it planned to take action against Hims, including restricting access to GLP-1 ingredients used in compounded drugs and referring the company to the Department of Justice. It cited concerns over quality, safety, and potential violations of federal law tied to mass compounding of weight-loss treatments.

Last week, FDA Commissioner Marty Makary said the agency would take “swift action” against companies mass-marketing illegal copycat drugs, adding that the FDA cannot verify the quality, safety, or effectiveness of non-approved drugs.

Novo, Lilly Push Back On Copycat Drugs

Within hours of Hims’ announcement, Novo Nordisk issued a statement calling the move illegal mass compounding of an unapproved, inauthentic, and untested semaglutide pill. The drugmaker said it would pursue legal and regulatory action to protect patients, its intellectual property, and the U.S. drug approval framework.

Novo said it is the only company producing an FDA-approved Wegovy capsule, which contains semaglutide formulated with its proprietary SNAC technology. The company said compounded semaglutide has not been approved by the FDA and could contain impurities, unnecessary ingredients, or experimental doses.

Rival drugmaker Eli Lilly also criticized compounded GLP-1 products. “No one should be mass-compounding or selling knockoff GLP-1 products regardless of how they’re administered,” a Lilly spokesperson told Reuters.

Paul Cerro, founder of Cedar Grove Capital Management, said on X that halting sales of the compounded pill was not a positive development. “Andrew flew too close to the sun, and now he’s bringing the entire knock-off telehealth industry down with him.”

Novo, Lilly, Hims Ramp Up Super Bowl Ads

The regulatory backdrop comes as weight-loss drugmakers ramp up advertising during Super Bowl 60, one of the year's largest global media events. Companies including Novo, Lilly, and Hims are spending millions on weight-loss commercials, Reuters reported.

Novo is promoting its newly launched Wegovy pill, while Lilly is advertising Zepbound during pre-game programming and on streaming platforms. Hims’ Super Bowl commercial focuses on healthcare access and features a voiceover by rapper Common.

How Did Stocktwits Users React?

On Stocktwits, retail sentiment for HIMS was ‘extremely bullish’ amid a 439% surge in 24-hour message volume.

"I think people have short memories. Remember back in November and December 2024: short float was over 30% and there was all that GLP-1 speculation. The price was at the same level back then, and that price didn't even factor in GLP-1. A year later, it's the same story and the same speculation, but with much stronger fundamentals. Short it all you want, I’m buying!" posted one user.

Another user said: "There will be no super-expensive legal fight with Novo" and added that "Tomorrow this stock will be free of that overhang and go GREEN!!!!!! This is very Good News!!!"

HIMS stock has fallen 43% over the past 12 months, while short interest stands at around 32%, according to Koyfin data, one of the highest levels among U.S.-listed healthcare stocks.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233719278_jpg_46dfac21ee.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263454468_jpg_23f4595a31.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2264020227_jpg_4d7420bef3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259210190_jpg_d48bbe3269.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1396534113_jpg_b0e09f299b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Jane_Street_3ac3fb6443.webp)