Advertisement|Remove ads.

Hive Swings To Profit In Q3 But Retail Worries Grow Over Bitcoin Slide, Possible Stock Dilution

Hive Blockchain Technologies Ltd. (HIVE) gained over 4% in pre-market trading Wednesday on better-than-expected third-quarter results but swung to the red when Bitcoin’s price dropped below the psychological support level of $95,000 before U.S. markets opened.

The company posted revenue of $29.2 million, surpassing analysts' expectations of $28.24 million and marking a 6.5% decline from the same quarter last year.

According to management, HIVE’s revenue was primarily derived from Bitcoin mining and HPC services, with $26.7 million generated from mining and $2.5 million from HPC.

The company reported a gross profit of $6.1 million, representing a 21% operating margin, but marking a 45% decline year-over-year (YoY).

However, HIVE turned a net income of $1.3 million, reversing a $7 million loss from the prior year.

On the Bitcoin front, HIVE mined 322 BTC during the quarter, bringing its total Bitcoin holdings to 2,805 BTC, valued at approximately $260.8 million.

Executive Chairman Frank Holmes highlighted the company's balance sheet strength, noting that Bitcoin holdings increased 263% year-over-year from $72 million in December 2023.

CFO Darcy Daubaras added that HIVE ended the quarter with $270.7 million in cash and digital assets, reinforcing its liquidity position.

HIVE's Bitcoin mining hash rate grew by 7.1% to 6.0 exahashes per second (EH/s) in December 2024, up from 5.6 EH/s in September. Management credited the improvement to the deployment of next-generation Avalon mining rigs from Canaan Inc.

CEO Aydin Kilic outlined the company’s aggressive expansion in Paraguay, targeting a fourfold increase in hash rate to 25 EH/s by September 2025.

The project includes a 300-megawatt (MW) expansion and a planned acquisition of the Yguazú site from Bitfarms Ltd., which would add another 200 MW upon completion. HIVE's global capacity, including existing sites in Canada and Sweden, is set to reach 450 MW by Q3 2025.

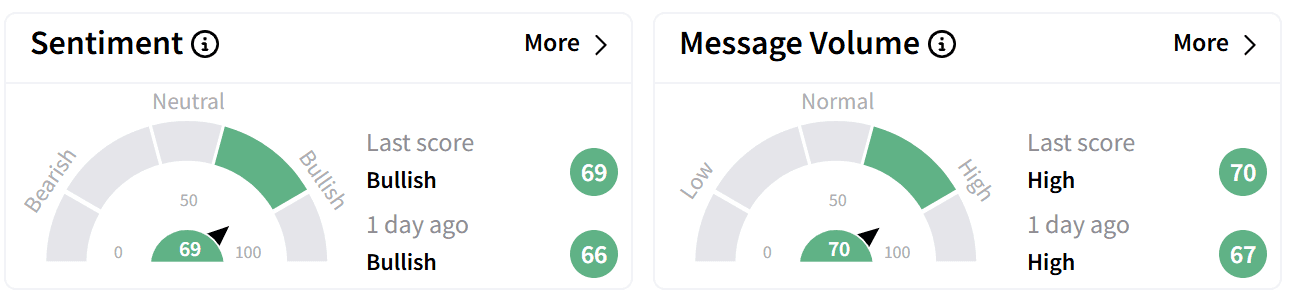

On Stocktwits, retail sentiment around the stock remained ‘bullish’ accompanied by ‘high’ levels of chatter.

However, some investors expressed concerns over potential dilution from HIVE’s At-The-Market (ATM) program, which allows for up to $200 million in common share sales.

The company has already raised $87.5 million through the issuance of 21.3 million shares at an average price of C$5.74 ($4), according to the earnings report.

Despite Bitcoin's price more than doubling over the past year, HIVE shares remain under pressure, down 8% year-to-date and nearly 25% over the past 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read also: BNB Defies Crypto Market Decline Amid Binance-SEC Legal Time-Out But Retail Still Turns Bearish

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2243334218_jpg_b1b7c1b222.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Johnson_and_Johnson_jpg_bc42927ca0.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2207639540_jpg_4ae2641504.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Jamie_Dimon_July_736ff90d31.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250241035_jpg_937df85f43.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_kashkari_original_jpg_b7db42a385.webp)