Advertisement|Remove ads.

Retail Trashes Home Depot After Firm Cuts Full-Year Sales Guidance

Home Depot on Tuesday managed to surpass analyst expectations on earnings and revenue but dialed-down its full-year guidance on sales and margin as it expects consumer demand uncertainty to persist.

The firm now expects comparable sales to decline between 3% and 4% year-over-year (YoY) for the 52-week period versus a prior guidance of a 1% decline. It has also revised its gross margin expectations to 33.5% compared to 33.9% earlier. Home Depot stated that the comparable sales decline of 3% implies a consumer demand environment consistent with the first half of fiscal 2024.

In Q2, revenue rose 0.6% YoY to $43.18 billion versus an estimate of $42.75 billion. Home Depot had acquired SRS Distribution earlier this year and for a total enterprise value of approximately $18.5 billion. The company said total sales include $1.3 billion from SRS Distribution, which represents approximately six weeks of sales in the quarter.

Earnings per share (EPS) came in at $4.60 compared to an estimate of $4.56. Net income fell 2.1% YoY to $4.56 billion.

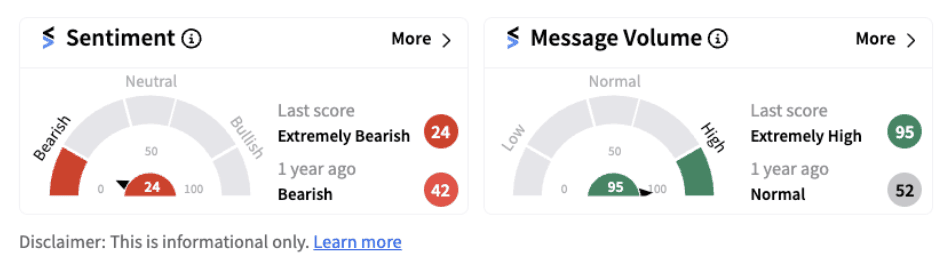

However, investors chose to focus on the sluggish guidance, with retail sentiment on Stocktwits falling into ‘extremely bearish’ territory (24/100) from ‘bearish’ a day ago, with message volumes hitting their highest in a year (95/100). Shares of the firm fell over 4.5% in Tuesday’s pre-market trading.

CEO Ted Decker remains confident the underlying long-term fundamentals supporting home improvement demand are strong. However, he noted that higher interest rates and greater macro-economic uncertainty pressured consumer demand more broadly during the quarter, resulting in weaker spend across home improvement projects.

Home Depot has kickstarted earnings in the retail space with Walmart, Macy’s, Target, and Best Buy scheduled to report their respective results in the coming days and weeks.

The company’s retail followers on Stocktwits were disappointed, as they believe the overall economy has hit the company’s performance and guidance.

/filters:format(webp)https://news.stocktwits-cdn.com/large_qatarenergy_jpg_907aa26daf.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262161352_jpg_832967dbca.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2243817419_jpg_fd782b2997.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2191224409_jpg_fd3e69e2d7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2229305833_jpg_f9b80a181a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Tom_Lee_9782f9c21f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)