Advertisement|Remove ads.

Home Depot, Shopify Earnings Preview: Here’s How Retail’s Prepping Ahead Of Results

Two retail giants Home Depot Inc ($HD) and Shopify Inc ($SHOP) are scheduled to report their earnings on Tuesday. Here’s a look at what Wall Street expects from the companies’ earnings report and how retail investors on Stocktwits have positioned themselves ahead of the event.

1. Home Depot: Shares of the home improvement retail firm were trading nearly 1% higher in Monday’s pre-market session. Analysts expect the company to report earnings per share (EPS) of $3.65 on revenues of $39.22 billion.

Home Depot is expected to report earnings before interest, tax, depreciation, and amortization (EBITDA) of $6.25 billion.

During the second-quarter earnings report announced in August, the company had said it expects full-year sales to increase between 2.5% and 3.5% including the 53rd week and comparable sales to decline between 3% and 4% for the 52-week period. Home Depot had also stated it expects to open approximately 12 new stores.

Investors will be watching out if the firm manages to retain or raise this guidance during the third-quarter earnings report.

Meanwhile, Telsey Advisory has reportedly upgraded Home Depot to ‘Outperform’ from ‘Market Perform’ with a price target of $455, up from $360. The brokerage expects further market share gains given the company’s "best-in-class execution and digital prowess." According to the firm, Home Depot has a "significant opportunity" to grow its Pro business by better serving complex pro customers, especially with the acquisition of SRS Distribution.

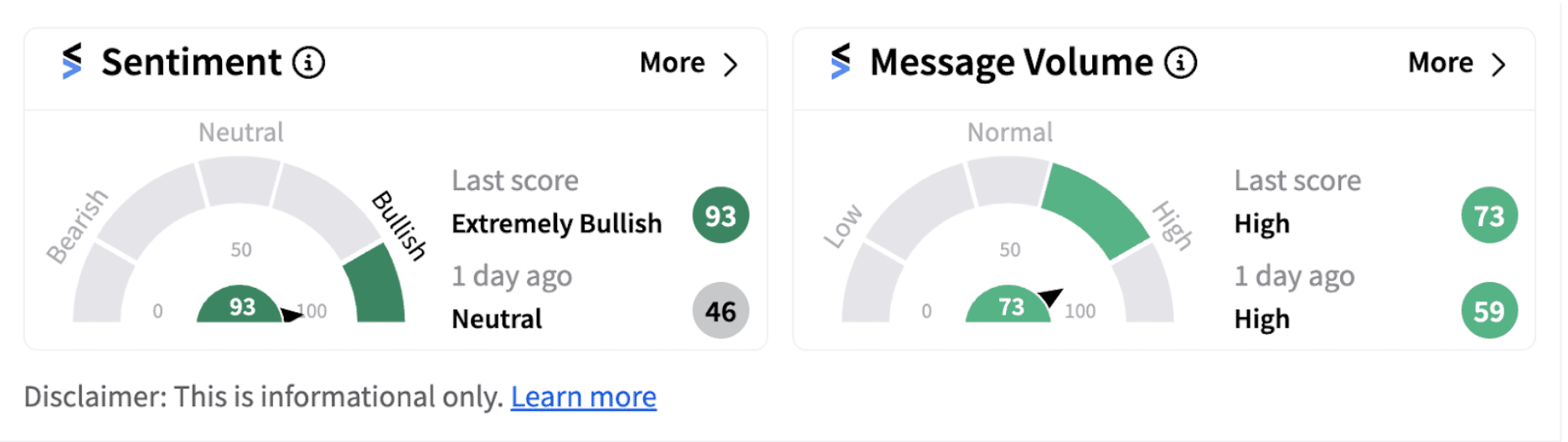

Retail sentiment on Stocktwits had closed in the ‘extremely bullish’ territory (93/100) on Friday, accompanied by high retail chatter.

2. Shopify Inc: Shares of Canadian e-commerce giant Shopify were trading higher by over 2% in Monday’s pre-market session. Wall Street expects the firm to report EPS of $0.27 on revenues of $2.11 billion.

Analysts expect the firm to report EBITDA of $346 million compared to $170 million in the same period a year ago.

During the second-quarter earnings report, Shopify had guided for third-quarter revenue to grow at a low-to-mid-twenties percentage rate on a year-over-year basis and gross margin to be higher by approximately 50 basis points compared to the second quarter.

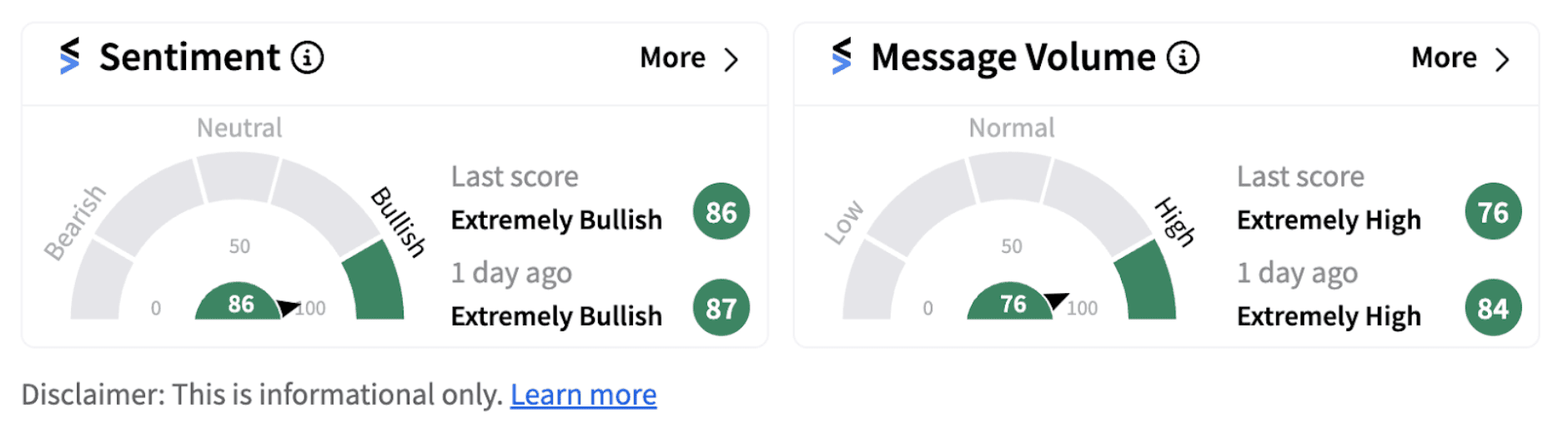

On Stocktwits, retail sentiment ended in the ‘extremely bullish’ territory (86/100) on Friday, with users expressing optimistic take on the stock.

Also See: US Election 2024: What Fed’s Neel Kashkari Says About Potential Trump Tariff Hikes, Fiscal Deficit

For updates and corrections email newsroom@stocktwits.com

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2192674502_jpg_9584afef8d.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2192591876_jpg_b8c2306674.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_oil_neww_a4e4f5f75e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2066552159_jpg_8ad95988f2.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1251938278_jpg_f5c0c94084.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Atlassian_logo_resized_cc57f67950.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)