Advertisement|Remove ads.

Honeywell Stock Hits Record Intraday High After Elliott Reveals $5B Stake, Calls For Breakup: Retail Bulls Rejoice

Shares of Honeywell International, Inc. ($HON) rose as much as 7.8% on Tuesday to a record high after activist investor Elliott Investment Management disclosed a significant $5 billion stake in the company.

This investment, representing roughly 3% of Honeywell’s current $150 billion market cap, reportedly marks Elliott’s largest single-stock investment to date.

Elliott believes that separating Honeywell’s Aerospace and Automation businesses could unlock substantial value, potentially driving the stock up 51% to 75% over the next two years.

In a letter to Honeywell’s board, Elliott partners Marc Steinberg and Jesse Cohn emphasized that Honeywell’s century-long legacy and strong market position have been overshadowed in recent years by “uneven execution” and “inconsistent financial results.”

“The conglomerate structure that once suited Honeywell no longer does, and the time has come to embrace simplification,” they said, referencing the successful break-ups of other industrial giants like General Electric and United Technologies.

Honeywell’s Chief Communicator Stacey Jones acknowledged Elliott’s investment, according to Bloomberg, stating, “Although Elliott had not made us aware of their views prior to today, we look forward to engaging with the firm to obtain their input.”

The development also comes after Honeywell recently announced plans to spin off its advanced materials division, marking its first major divestiture in nearly a decade.

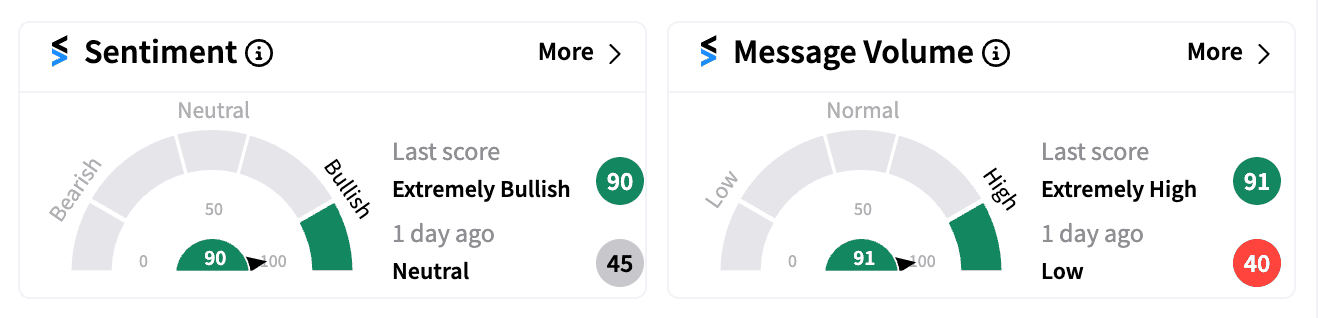

On Stocktwits, retail sentiment turned ‘extremely bullish’ following the news, with a noticeable spike in message volume.

Despite its strong legacy, Honeywell has reportedly lagged behind its peers over the past five years, with its stock gaining only about 30%, compared to the 76% increase recorded by the S&P 500 Industrials Sector index.

Earlier, activist pressure from Dan Loeb’s Third Point LLC in 2017 led to the spinoff of Honeywell’s Resideo Technologies Inc. and Garrett Motion Inc. units, but not its Aerospace segment, according to Bloomberg.

With Elliott’s push for further restructuring, Honeywell’s stock is up 12% year-to-date, trailing behind the broader market gains of the S&P 500 and the Nasdaq.

However, the news of Elliott’s substantial stake and proposed strategic changes has reinvigorated investor interest, positioning Honeywell for potential upside if the break-up plans materialize.

For updates and corrections, email newsroom@stocktwits.com

Read next: EVgo Stock Charges Ahead On Revenue Beat, Optimistic Outlook: Retail Sentiment Soars

/filters:format(webp)https://news.stocktwits-cdn.com/large_altimmune_jpg_8f251e2911.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2229918735_jpg_e905cbd5e3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Netflix_jpg_ed6fa4554b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_paramount_skydance_warner_bros_discovery_jpg_709742214d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Broadcom_jpg_f302b01f15.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_new_york_stock_exchange_jpg_e1f85c0d8c.webp)