Advertisement|Remove ads.

EVgo Stock Charges Ahead On Revenue Beat, Optimistic Outlook: Retail Sentiment Soars

EVgo, Inc. ($EVGO) shares surged more than 5% on Tuesday morning following the company’s strong third-quarter (Q3) earnings report and optimistic outlook for the remainder of the year.

The EV charging network operator reported a Q3 loss per share of $0.11, slightly worse than the consensus estimate of a $0.09 loss. However, adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) loss of $8.9 million was better than a feared $11 million loss.

Revenue for the quarter came in at $67.5 million, surpassing the consensus of $65.95 million.

More impressively, EVgo’s network throughput saw a massive 111% year-over-year growth, reaching 78 GWh.

The company added more than 147,000 new customer accounts during the quarter, a 39% increase from the previous year, bringing its total customer accounts to over 1.2 million.

"I'm pleased to report another record quarter anchored by strong revenues and triple digit year-over-year network throughput growth," said CEO Badar Khan.

He also noted the company’s ability to bring “a record number” of charging stalls online during Q3.

“With our conditional commitment from DOE [Department of Energy] for a loan guarantee of up to $1.05 billion announced last month, EVgo is poised to lead the industry as the charging provider of choice,” he said, which quelled fears among some investors about a new Trump administration rolling back the financial aid.

EVgo raised its revenue guidance’s midpoint for the full year by $2.5 million, expecting total revenue to fall between $250 million and $265 million, versus the consensus estimate of $257.34 million.

The company now forecasts a full-year adjusted loss between $38 million and $32 million, raising the midpoint of a previous guidance by $4 million.

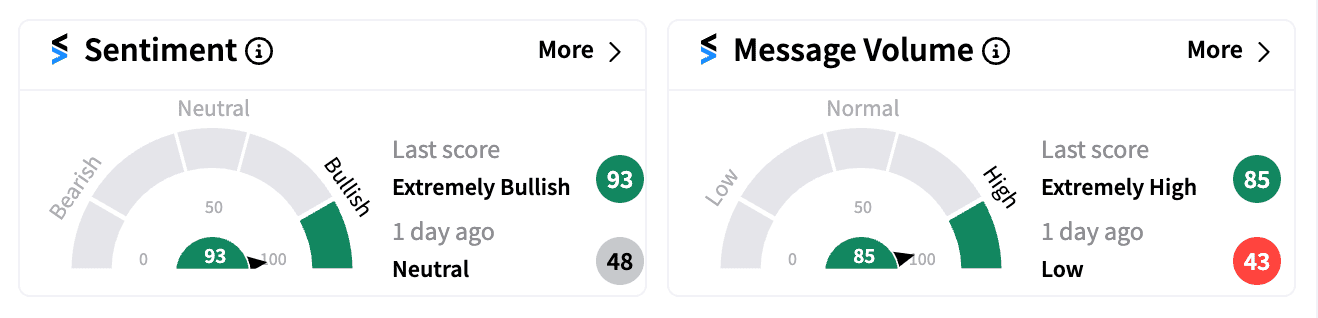

Following the earnings release, retail sentiment for EVgo on Stocktwits flipped into ‘extremely bullish’ territory, with a noticeable surge in message volume.

One user pointed to the CEO’s comments on the DOE loan guarantee, which helped put to rest doubts about the funding, while another expressed confidence that EVgo would continue to rise, targeting the $9 range.

EVgo’s short interest has recently increased, climbing from 28.4% to 31.5%, its highest in three months, with days-to-cover extending to 5.1.

Raising optimism within the sector, U.S. EV sales rose 11% year-over-year in Q3, according to recent data from Cox Automotive.

EVgo’s stock has surged more than 60% year-to-date, reflecting growing investor confidence in the company’s position in the rapidly expanding charging market.

For updates and corrections, email newsroom@stocktwits.com

Read next: US Election 2024: Bitcoin, Dogecoin Ride Trump Crypto Wave Higher As Retail Bets On Bigger Gains

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2218181288_jpg_d22b8a81ff.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2243840626_jpg_6a78fa8844.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_jeff_merkley_jpg_aca807f10f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_rising_resized_f17852d7aa.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2230437216_jpg_6078a75ee4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2149037439_jpg_ab9f73d5f7.webp)