Advertisement|Remove ads.

Mamaearth Parent Honasa Consumer Rallies After Q4 Print: SEBI RA Aditya Hujband Flags Bullish Momentum

Shares of Honasa Consumer, the parent company of skincare brand Mamaearth, soared 16% in Friday’s trade after the company posted a robust 13.3% year-on-year revenue growth in the March quarter, reaching ₹533.5 crore.

The strong topline performance came despite a dip in bottom-line figures and operational profitability.

Net profit declined by 17.8% to ₹25 crore, while EBITDA fell 18.5% to ₹26.9 crore, resulting in a contraction of EBITDA margin to 5%, down from 7% a year ago.

However, the company’s gross profit margin improved to 70.7%, aided by a better product mix and enhanced operational efficiencies.

SEBI-registered analyst Aditya Hujband noted the company’s strategic initiatives that have streamlined operations and positioned Honasa for more sustainable growth.

He also highlighted the performance of The Derma Co, one of Honasa’s emerging brands, which has reached a ₹100 crore annualized revenue run-rate in offline channels

On the technical front, Hujband identified a strong breakout above the recent consolidation zone, backed by heavy trading volumes and price action staying above all key moving averages.

The Relative Strength Index (RSI) has moved above 85, suggesting the stock is currently overbought. This may prompt short-term consolidation or profit booking, but the momentum remains bullish.

He flagged key resistance levels at ₹400–₹410, while immediate support lies between ₹275–₹280.

Hujband also warned investors of certain red flags: a low promoter holding of just 35%, elevated valuation metrics including a P/E ratio of 157 and PEG of 9.48, and subpar return ratios (ROCE at 7.44%, ROE at 5.51%).

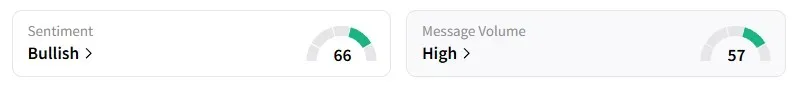

Data on Stocktwits shows that retail sentiment has turned ‘bullish’, up from ‘neutral’ a week ago, reflecting growing confidence in Honasa’s growth trajectory.

Honasa shares have gained 25% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2218096416_jpg_9d469a2ec6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2229019640_jpg_c6006d7238.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_adam_smigielski_K5m_Pt_O_Nmp_HM_unsplash_f365ee93f4.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_jpg_fc59d30bbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1190665957_jpg_92088206ed.webp)