Advertisement|Remove ads.

Howmet Aerospace Boosts 2025 Outlook, Beats Q1 Estimates On Strong Aircraft Parts Orders: Retail’s Extremely Bullish

Howmet Aerospace (HWM) stock rose 6.8% on Thursday after the aerospace firm raised its 2025 earnings forecast.

The Pittsburgh-based company projected full-year adjusted earnings in the range of $3.36 to $3.44 per share, compared with its earlier forecast of $3.13 to $3.21 per share.

Howmet also expects to generate free cash flow between $1.10 billion and $1.20 billion this year, compared with its earlier forecast of between $1.03 billion and $1.13 billion.

The company reported first-quarter adjusted earnings of $0.86 per share, compared with Wall Street’s expectations of $0.78 per share, according to FinChat data.

Howmet said while there has been some recent moderation in North American traffic growth, driven by tariff-related and economic uncertainty, overall air travel continues to grow, led by Europe and the Asia Pacific region.

“Howmet Aerospace’s engine and airframe OEM customers continue to demonstrate growth, with record backlogs supported by under-build of aircraft in recent years and the desire for new, fuel-efficient aircraft,” CEO John Plant said.

However, tariff uncertainties have led to some airlines warning about aircraft order cancellations if aircraft prices rise due to tariffs.

"Could I envisage that certain airlines might begin to cancel aircraft in the coming year? Well, I think it's possible, but that very much depends upon really what the passenger traffic is," Plant said.

The company also confirmed that it had sent letters of force majeure to customers and has certain contract provisions to protect pricing.

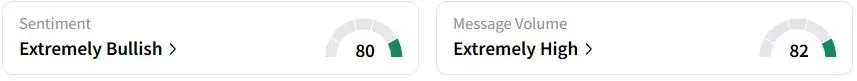

Retail sentiment on Stocktwits was in the ‘extremely bullish’ (80/100) territory, while retail chatter was ‘extremely high.’

Howmet Aerospace stock has gained 34.3% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Stock_chart_representative_image_resized_jpg_dacf5b1590.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trump2_jpg_ad63f384b5.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1247400381_jpg_765e6ec016.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_atm_original_jpg_afc73e9be7.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_GE_Aerospace_resized_1_jpg_03f4fd7e4e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2260447662_jpg_cd246b74f6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)