Advertisement|Remove ads.

Hut 8 Stock Surges On Profit Boom But Q4 Revenue Misses Estimates – Retail Sentiment Turns Bullish

Bitcoin miner Hut 8 (HUT) climbed about 4% in afternoon trading Monday after posting a sharp rise in net income for 2024, despite weaker revenue in the fourth quarter.

In the final quarter of the year, revenue fell to $31.7 million from $38.9 million a year earlier, missing analysts’ estimates of $38 million, according to Koyfin.

However, net income for the period jumped to $152 million from $10.6 million in the previous year. The significant jump was driven by gains on digital assets worth $308.2 million during the quarter.

The company reported a full-year revenue of $162.4 million, with net income surging to $331.4 million.

Hut 8 ended the year with 10,171 Bitcoin (BTC) in reserves, worth roughly $905 million at current prices.

A significant portion of these holdings has been pledged as collateral for purchasing additional ASIC mining machines as the company scales its operations.

The miner said it benefited from a steep drop in energy costs, with its average cost per megawatt-hour falling 30% from the previous year to $31.63 in Q4.

It managed around 1,020 megawatts (MW) of mining power at the end of December, with over 12,300 MW in its development pipeline.

CEO Asher Genoot said the company is realigned its operating segments around three layers of Hut 8’s platform – power, digital infrastructure and compute – as the company expands into artificial intelligence.

Hut 8’s subsidiary, Highrise AI, signed a five-year customer agreement for GPU-as-a-Service.

Additionally, the company secured a $150 million strategic investment from Coatue to accelerate its AI infrastructure initiatives.

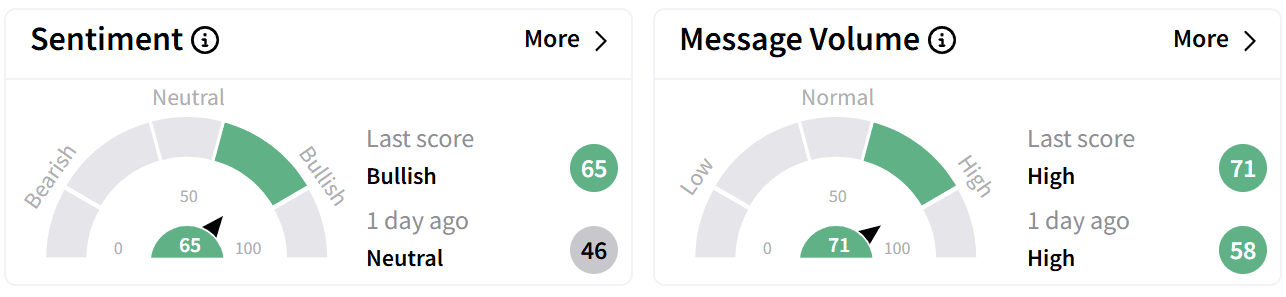

On Stocktwits, retail sentiment around Hut 8’s stock improved to ‘bullish’ from ‘neutral’ a day, accompanied by ‘high’ levels of chatter.

Some traders speculated the stock would have moved higher if not for Bitcoin’s pullback below $90,000 in U.S. trading, following its weekend surge after former President Donald Trump announced a ‘crypto strategic reserve.’

Hut 8 shares have gained 64% over the past year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Morgan_Stanley_HQ_logo_5431c7f2ad.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1549425533_jpg_483afd6d69.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_down_resized_901c19c371.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2235778544_jpg_2b7ceca102.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_hawaiian_electric_resized_4b766fd741.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)