Advertisement|Remove ads.

iSpecimen Stock Surges 60% After Hours Off A Record Low — What Triggered The Turn?

- The after-hours move followed a newly announced private placement that provides near-term funding visibility.

- The financing terms outline convertible preferred shares tied to future common stock pricing.

- The announcement came after a prolonged decline that had taken the stock to its lowest recorded level.

Shares of iSpecimen Inc. (ISPC) jumped about 60% in after-hours trading on Tuesday, rebounding from a record low after the company announced a $5.5 million private placement that appeared to ease near-term liquidity concerns.

Capital Raise Sparks Relief Rally

The company said it entered into a securities purchase agreement with accredited investors for gross proceeds of nearly $5.5 million, before fees. The financing involves the issuance of 6,875 shares of newly designated Series C Convertible Preferred Stock priced at $800 per share.

Each preferred share has a stated value of $1,000 and can be converted into common stock at a price equal to 85% of the prior day’s closing price. iSpecimen said the funds will go toward marketing, working capital, and other general corporate needs, with the transaction expected to close around Dec. 31.

What Went Wrong Before The Bounce

According to the company’s SEC filings, iSpecimen has reported recurring operating losses over multiple years, generated limited revenue relative to expenses, and financed operations through multiple equity and convertible security offerings.

iSpecimen has yet to achieve sustained profitability from its biospecimen marketplace, with operating expenses consistently exceeding revenue. The company has also repeatedly disclosed the need for additional capital to continue operations, pointing to pressures that weighed on the stock and pushed shares to a record low.

Crypto Strategy Adds Volatility

Investor uncertainty was amplified earlier this year after iSpecimen announced plans to pursue a corporate treasury strategy tied to the Solana blockchain ecosystem.

In August, the company said it was exploring the creation of an up to $200 million digital asset treasury centered on Solana, later disclosing that it had been approached by cryptocurrency-related firms regarding tokenized assets and treasury opportunities.

The company said the proposed digital asset treasury would be funded primarily through capital that may be raised from time to time, according to its August and September disclosures.

How Did Stocktwits Users React?

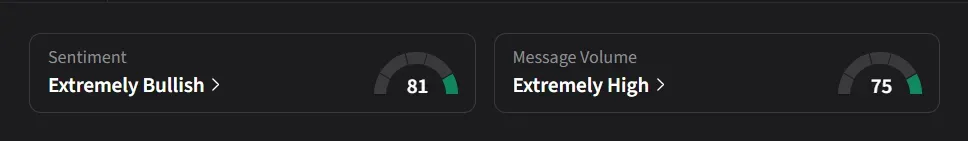

On Stocktwits, retail sentiment for iSpecimen was ‘extremely bullish’ amid ‘extremely high’ message volume.

iSpecimen’s stock has declined 89% so far in 2025.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Visa_resized_82d951e81e.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1218279776_jpg_d381694a09.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2199360480_jpg_41abd97106.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Palantir_jpg_d29fd424cd.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2217223717_jpg_e05dddbc9f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_sea_ltd_jpg_b4cc09a88d.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)