Advertisement|Remove ads.

ICICI Lombard Nears Breakout Ahead Of Q1 Results: SEBI RA Rohit Mehta Flags Strong Technicals

ICICI Lombard General Insurance is displaying bullish patterns ahead of reporting its Q1FY26 results on Tuesday. The stock is around 11% below its all-time high of ₹2,286.55, signaling strong relative strength ahead of its results.

The stock is forming a cup-shaped recovery pattern, marked by higher lows and a gradual climb, a typical setup suggesting bullish continuation. A sustained move above the ₹2,100 resistance zone could open the door for a potential all-time high retest, said SEBI-registered analyst Rohit Mehta.

From a technical perspective, the structure remains solid. The key support lies in the ₹1,613 - ₹1,679 zone, and the trend bias stays bullish as long as the stock holds above ₹1,680, Mehta said.

Fundamentally, while Q4 FY25 numbers showed some softness, with operating profit down 11.74% and EPS declining by 2.74%. However, it is nearly debt-free, maintains a 27.1% dividend payout ratio, and has delivered consistent long-term growth, with a 10-year median sales CAGR of 15.1%.

Institutional activity was mixed last quarter, with FII holdings dipping while DII exposure increased modestly.

ICICI Lombard shares closed little changed at ₹2,014, having gained 12.5% year-to-date (YTD).

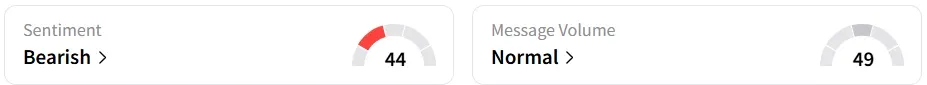

Retail sentiment on Stocktwits has remained ‘bearish’ over the past month.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_adam_smigielski_K5m_Pt_O_Nmp_HM_unsplash_f365ee93f4.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_jpg_fc59d30bbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1190665957_jpg_92088206ed.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2235337192_jpg_56c00409cf.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_marvell_logo_OG_jpg_dfc748dd9b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2232147590_jpg_a31aecbfad.webp)