Advertisement|Remove ads.

ICICI Prudential Life Delivers Steady Q1 Earnings, Charts Signal Bullish Breakout: SEBI RA Rajneesh Sharma

ICICI Prudential Life shares rose 1% on Tuesday after reporting a steady show in first quarter (Q1 FY26) earnings.

The earnings performance was backed by margin stability, retail protection traction, and a technically significant breakout, according to SEBI-registered analyst Rajneesh Sharma.

Q1 Earnings Highlight

ICICI Prudential Life reported a 34.2% rise in profits at ₹302 crore, supported by higher investment income. Net premium income rose 8.1% to ₹8,954 crore, while assets under management (AUM) rose 5% to ₹3.24 lakh crore.

Specific growth metrics were soft, though. Annualised Premium Equivalent (APE) fell 5%, and Value of New Business (VNB) slipped 3.2%. However, VNB margins grew slightly to 24.5%.

Sharma noted that in its FY25-end commentary, the management outlined three strategic pivots: deepen retail protection, scale annuity book, and optimize costs across acquisition & operations. And they delivered on those fronts as retail protection APE rose 24.1%, annuity grew 14.9% and the cost-to-premium ratio in savings improved by 270 bps.

Technical Charts Show Breakout

On the technical front, ICICI Prudential shares staged a decisive breakout from a long-term falling wedge pattern, with a weekly gain of 4%. The breakout is confirmed with volumes and a retest of the support levels at ₹674–₹680 and resistance at ₹720–₹725.

If the stock breaches this level, Sharma identified targets of ₹760–₹800 in the coming months. The medium-term outlook is cautiously bullish, with ₹725 as the next test. And over the long term, his view remains positive, especially if the ₹720–₹725 resistance is convincingly passed with the stock likely to test ₹800 and higher.

Sharma concluded that ICICI Prudential Life has begun FY26 with margin stability, cost discipline, and a bullish technical setup that validates the outlook.

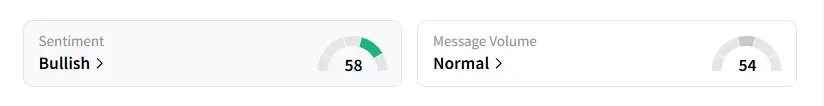

Data on Stocktwits shows that retail sentiment turned ‘bullish’ on this counter a day ago.

ICICI Prudential Life shares are up 3% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2218096416_jpg_9d469a2ec6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2229019640_jpg_c6006d7238.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_adam_smigielski_K5m_Pt_O_Nmp_HM_unsplash_f365ee93f4.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_jpg_fc59d30bbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1190665957_jpg_92088206ed.webp)