Advertisement|Remove ads.

IDBI Bank Shares: SEBI RA Bullish After Strong Q1, Sees Over 30% Upside Potential

Earlier this week, IDBI Bank posted its quarterly results with net profit climbing 17% to ₹2,007 crore and total income rising 13% to ₹8,458 crore. However, net interest income declined slightly to ₹3,166 crore, and net interest margin compressed by 50 bps to 3.68%.

Asset quality continued to improve, with gross NPA falling to 2.93% and net NPA to 0.21%. The provision coverage ratio remained high at 99.31%.

The Current Account and Savings Account (CASA) ratio remains above 50% and its strong balance sheet is supported by a Capital to Risk-Weighted Assets Ratio (CRAR) of 25.39% and CET-1 ratio at 23.71%.

Technical Outlook

IDBI Bank stock is consolidating within a narrow range of ₹90 - ₹105, said SEBI-registered analyst Varunkumar Patel. The stock’s sideways structure suggests temporary indecision, he added.

A breakout above ₹102, especially with volume support, could propel the stock toward ₹125 - ₹130 in the short term.

On the downside, support lies near ₹87, with ₹81 being a key pivot. Any break below this level could signal weakness towards the ₹65-₹72 zone, Patel said.

The relative strength index (RSI) sits near 47.5, indicating a neutral bias, while volume spikes seen in late June hint at accumulation interest. The medium-term trend remains positive as long as ₹87 holds, he added.

With a renewed focus on retail lending, digital transformation, and sustained profitability, IDBI Bank appears well-positioned for continued outperformance.

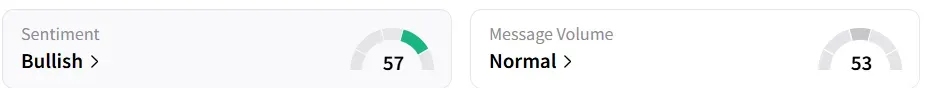

Retail sentiment on Stocktwits shifted to ‘bullish’ on the back of the Q1FY26 results. It was ‘neutral’ a day earlier.

The stock closed 2.2% higher on Wednesday at ₹97.39 and has gained more than 27% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2244672917_jpg_95b721e1af.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2195597245_jpg_c1df83b829.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_paypal_BTC_ETH_OG_jpg_566a59dd7c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2250929484_jpg_8206df84ab.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2189355808_jpg_c13dd12a0f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2195599761_jpg_ec0e618b8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)