Advertisement|Remove ads.

IEX Shares: SEBI RA Deepak Pal Sees Nearly 15% Upside Potential

Indian Energy Exchange (IEX) has been undergoing a corrective phase over the past three trading sessions, following news of market coupling, which led to a nosedive in shares, according to SEBI-registered analyst Deepak Pal.

Market coupling streamlines electricity trading by combining bids from various power exchanges to establish one uniform price across the country. In IEX’s case, investor sentiment turned cautious on the possibility of the company losing market share.

However, with the news largely absorbed, the stock now appears to be stabilizing and showing early signs of recovery, hinting at a potential attempt to reclaim previous levels, Pal observed.

IEX stock closed 0.5% higher on Wednesday at ₹188.66. It had shed over 3% in the past month.

Technically, the 200-day exponential moving average (EMA) near ₹175 is acting as a solid support zone. The stock has been successfully staying above its 14-day and 55-day EMAs, signaling underlying strength.

For positional traders, any minor dip toward the ₹188–189 range could present a favourable entry opportunity, with a stop loss placed near ₹175. Pal noted that if the current momentum sustains, the stock has the potential to retest the ₹210–215 zone over the next few weeks, a near 15% premium to the current market price.

According to reports, Bernstein SocGen Group upgraded IEX stock rating to ‘Market Perform’ from ‘Underperform’, raising its price target to ₹160 from ₹152.

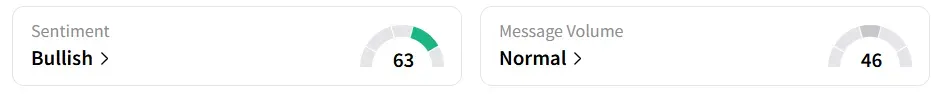

Retail sentiment on Stocktwits remained ‘bullish’.

Year-to-date (YTD), the stock gained nearly 4%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_adam_smigielski_K5m_Pt_O_Nmp_HM_unsplash_f365ee93f4.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_jpg_fc59d30bbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1190665957_jpg_92088206ed.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2235337192_jpg_56c00409cf.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_marvell_logo_OG_jpg_dfc748dd9b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2232147590_jpg_a31aecbfad.webp)