Advertisement|Remove ads.

Immunic Stock Draws Investor Attention On $5.1M Registered Direct Offering: Retail’s On Wait-And-Watch Mode

Shares of biotechnology company Immunic, Inc. (IMUX) drew investor attention on Wednesday morning after the company announced it is looking to raise about $5.1 million through a registered direct offering led by Aberdeen Investments.

The company said it would sell 5.67 million shares of its common stock at $0.90 per share, or its closing price on Tuesday.

Immunic intends to use the net proceeds from the proposed offering to fund its clinical trials and operations and for other general corporate purposes. The offering is expected to close on or about April 10.

Earlier this year, Immunic, which is developing a clinical pipeline of orally administered, small-molecule therapies for chronic inflammatory and autoimmune diseases, said that it expects to be able to fund its operations into the third quarter of 2025.

As of September 30, 2024, the company had cash and cash equivalents of $59.1 million.

The firm’s lead development program, Vidofludimus Calcium, is currently in phase 3 and phase 2 clinical trials for treating relapsing and progressive multiple sclerosis, respectively.

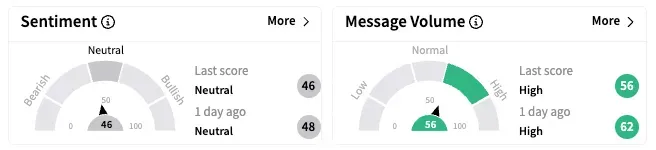

On Stocktwits, retail sentiment around Immunic dipped marginally into ‘neutral’ territory, coupled by a six-point drop in message volume over the past 24 hours.

A Stocktwits user expressed doubt about the company raising millions before providing data from its ongoing trials.

Another said IMUX will do well if it registers positive trial data this month.

IMUX shares have been down by nearly 12% this year and by over 30% over the past 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_jpg_eb6402d336.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_OG_3_jpg_94334765ec.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ondas_OG_jpg_05cf209e61.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_moonlake_jpg_376bc698df.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_QR_OG_jpg_08610d948a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1230125578_jpg_85f30da0d4.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)