Advertisement|Remove ads.

India Market Wrap: India-Pakistan Ceasefire, US-China Tariff Cuts Push Nifty Toward 25,000; IT, Metal Stocks Shine

Dalal Street witnessed a stellar rally on Monday following a ceasefire agreement between India and Pakistan, which eased geopolitical tensions. The benchmark indices saw their best single-day performance in four years.

Adding to the positive sentiment, the U.S. and China agreed to reduce reciprocal tariffs, including a 90-day halt on trade measures and a 115% tariff cut as part of the deal.

The Nifty 50 closed 916.70 points higher at 24,924.70 while the Sensex rallied by 2,975.43 points to 82,429.90.

The Nifty Midcap index rose 4%, reflecting strong participation from broader markets.

All sectoral indices ended in the green, with IT and metals leading the charge.

The Nifty IT index jumped 7% —registering its best performance in five years — on expectations of improved global demand following the tariff rollback.

Adani Enterprises, Infosys, Wipro, Trent, Shriram Finance, and HCL Tech were among the top gainers on the Nifty. Barring IndusInd Bank and Sun Pharma, all other index constituents ended in the green.

Following the U.S.-China deal announcement, IT and metal stocks witnessed significant gains, with the Nifty IT index (+7%) recording its biggest rise in five years.

Aviation and tourism stocks also saw strong buying. Indigo and SpiceJet rallied 7% each, while Indian Hotels, Chalet Hotels, and IRCTC surged between 6% and 9%.

LTIMindtree climbed 7% after announcing its largest-ever deal—a $450 million, seven-year strategic contract with a leading global agribusiness firm.

On the flip side, pharma stocks lagged, with Sun Pharma falling 3% after U.S. President Donald Trump revived proposals to cut drug prices—a move that could weigh on exports to the American market.

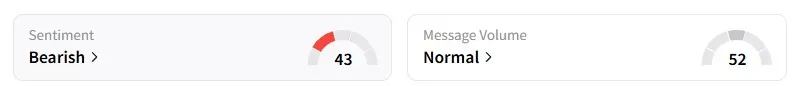

Despite the exuberance in the market, retail sentiment surrounding the Nifty 50 on Stocktwits turned ‘bearish.’

Globally, European markets traded higher, while U.S. stock futures pointed to a strong start.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Apple_Siri_jpg_30dce91b4f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2257248307_jpg_6720435e43.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2248586785_jpg_9c6ef18a07.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_btc_x_96cc54b79b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_brian_armstrong_coinbase_2_jpg_59a44ebea9.webp)