Advertisement|Remove ads.

Indian Hotels May Test ₹800 As Technical Indicators Signal Reversal: SEBI RA Deepak Pal

Indian Hotels is showing signs of a strong recovery after a period of consolidation and could be heading for a fresh rally, according to SEBI-registered analyst Deepak Pal.

On the daily chart, the stock rebounded sharply from its 200-day exponential moving average (EMA), indicating a key support zone of ₹735 - ₹740, Pal noted.

The moving average convergence/divergence (MACD), a key technical momentum indicator, remains in the negative zone but is now converging, suggesting a potential trend reversal if momentum builds.

The relative strength index (RSI) is currently around 50, reflecting neutral momentum and room for upward movement, Pal said. Additionally, Parabolic SAR dots have flipped below the price, indicating a short-term bullish outlook.

Pal added that if the stock sustains above ₹770, it may trigger a breakout rally towards the ₹790–₹800 zone, a 5% upside from the current price. On the downside, ₹740 remains a critical support level.

Overall, the technical structure suggests that a recovery phase is underway, particularly if broader market cues remain supportive, he observed.

From a trading perspective, accumulation can be considered around ₹750–₹751, with a short-term support at ₹700. If momentum continues, the stock holds potential to test levels up to ₹850.

Tata-backed Indian Hotels, which operates popular brands such as Taj and Vivanta, recently reported strong fourth-quarter results, with a 30% growth in net profit.

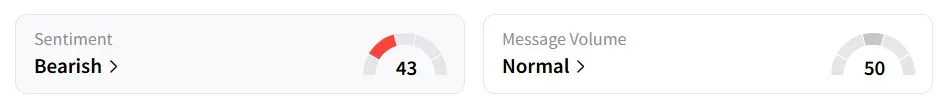

Retail sentiment on Stocktwits remained ‘bearish’.

At the time of writing, Indian Hotels stock was marginally down at ₹762 per share. Year-to-date, the shares were down nearly 13%

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2264020227_jpg_4d7420bef3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259210190_jpg_d48bbe3269.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1396534113_jpg_b0e09f299b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Jane_Street_3ac3fb6443.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Truth_social_5bfbc7389b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2221283194_jpg_8178c730a4.webp)