Advertisement|Remove ads.

Infosys Q1 Preview: SEBI RAs Sees Near-term Caution, Markets Eye FY26 Commentary

IT firm Infosys is scheduled to report its Q1FY26 earnings after market hours on Wednesday. Markets will be looking for some respite after peers Tata Consultancy Services (TCS) and HCL Technologies reported disappointing results earlier this month.

However, reports suggest that Infosys is expected to report modest sequential growth in revenue and EBIT. Most brokerages believe the company could revise the lower end of its FY26 revenue growth guidance upward from the earlier 0 - 3% range, supported by stable macro conditions and healthy deal momentum, though a sharp rise in the upper end is unlikely.

Consolidated revenue is expected to grow to ₹41,724 crore, while EBIT may rise to ₹8,727 crore, with margins holding steady near 20.9%, as per Bloomberg estimates.

Fundamentally, the company offers a solid return on equity of over 30% and maintains a debt-free balance sheet. It is backed by a strong order book in digital and automation services across North America and Europe.

The broader sentiment around IT remains cautious, driven by macroeconomic headwinds from the U.S. and pressure on BFSI clients. Despite these challenges, the company has attempted to defend its margins through cost control and securing large deal wins.

Infosys shares closed 0.6% lower at ₹1,575 on Tuesday.

Technical Outlook

According to SEBI-registered analyst Deepak Pal, the stock is showing signs of short-term technical weakness ahead of the results.

Infosys shares slipped below its short-term moving averages, with Parabolic SAR dots above the price and a bearish moving average convergence/divergence (MACD) crossover indicating fading momentum. The relative strength index (RSI) stands at 41.15, indicating a decline in strength, although it has not yet entered oversold territory.

Structurally, the stock is in a lower-high, lower-low pattern, signaling a downtrend, Pal noted. A breakdown below ₹1,580 could lead to a fall to ₹1,550 - 1,540 levels. Resistance now lies in the ₹1,600 - 1,610 zone.

While long-term fundamentals remain intact, the analyst recommends waiting for post-result clarity before making fresh entries. Accumulation on dips could be considered if key supports hold, he added.

SEBI RA Rohit Mehta said that the stock is in a corrective phase on the daily chart, but appears to be forming a base around the key support zone of ₹1,525 - ₹1,558.

Price action suggests possible accumulation, but a breakout above ₹1,650 is needed to confirm trend reversal. If the support holds and results exceed expectations, a short-term rally could follow, Mehta said.

However, even as near-term caution persists, Infosys’s strong fundamentals and support at current levels are likely to lead to recovery, he added.

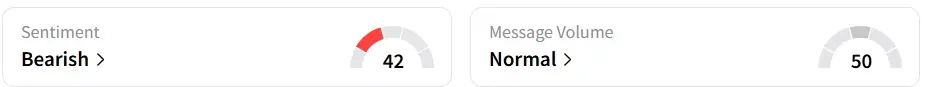

Retail sentiment on Stocktwits turned ‘bearish’ from ‘neutral’ a week earlier.

Year-to-date losses stand at 16.5%.

For updates and corrections, email newsroom[at]stocktwits[dot]com

/filters:format(webp)https://news.stocktwits-cdn.com/large_Apple_Siri_jpg_30dce91b4f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2257248307_jpg_6720435e43.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2248586785_jpg_9c6ef18a07.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_btc_x_96cc54b79b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_brian_armstrong_coinbase_2_jpg_59a44ebea9.webp)