Advertisement|Remove ads.

Infosys Q1 Review: AI Optimism, Deal Wins Boost Earnings But Stock Lacks Momentum, Says SEBI RA Rajneesh Sharma

Infosys released its earnings for the June quarter (Q1 FY26) after market hours on Wednesday, and the headline numbers show a steady performance, supported by large deal wins and AI-driven optimism.

The IT major has raised its lower band of revenue growth guidance to 1% to 3%, up from 0% to 3%, while maintaining its margin guidance at 20-22%.

But SEBI-registered analyst Rajneesh Sharma noted a disconnect between Infosys’s solid delivery and lack of stock market enthusiasm, pointing to market expectations for stronger guidance and margin expansion.

While free cash flow generation (₹7,533 crore) and large deal wins provide confidence for long-term investors, traders are likely to wait for a clear break of technical levels, he added.

Infosys stock ended nearly 1% lower ahead of its earnings report.

Q1 Earnings Snapshot

Revenues rose 7.5% to ₹42,279 crore, exceeding expectations but driven more by volume and mix rather than pricing improvements, Sharma observed. Net profit stood at ₹6,921 crore, growing 8.6% year-over-year, as margins faced mild pressure due to ongoing AI investments and hiring stabilization.

The operating margin held steady at 20.8%, indicating cost discipline. Sharma highlights that it is not enough margin expansion to excite markets.

What’s Worked For Infosys?

The tech major reported $3.8 billion in large deal wins, with 55% of those being net new clients. Additionally, Infosys’ AI initiatives (Project Maximus and Topaz AI) has helped differentiate them from their peers, such as TCS and Wipro, who are still focusing on legacy cloud, he added.

Geographically, Europe led with 16.2% year-over-year growth, reflecting a macroeconomic recovery and an increased wallet share in the BFSI and manufacturing sectors in the region. The manufacturing vertical grew 14.8% year-over-year (YoY), but the life sciences sector declined by 6.6%, signaling pricing pressure or lost contracts, which warrants close monitoring next quarter.

The management commentary focused on AI, deal wins and client consolidation, along with their “cash flow resilience”. Sharma noted that this is their fifth consecutive quarter with over 100% free cash flow conversion.

Overall, he believes that Infosys is better positioned than most peers, but the market is looking for companies with explosive growth narratives. Additionally, Infosys’ valuations are considered fair, suggesting that the stock may serve as a defensive holding rather than a momentum leader until it clears the ₹1,645 resistance, according to Sharma.

Technical Trends

On the technical charts, Infosys faces resistance at ₹1,629–₹1,645, termed as a ‘wall of supply’ by the analyst. A breakout above this level could trigger short-covering and potentially drive the share price toward ₹1,700.

On the downside, ₹1,517 is seen as a make-or-break level. So far this level has held, but the pattern suggests a bearish bias unless the stock reclaims ₹1,645 with strong volume.

Even the volumes show no conviction from bulls, which means that institutional investors are cautious on the sidelines for now. He highlighted that Infosys’ current price action indicates a distribution zone, rather than a breakout.

Sharma concluded that while Infosys remains fundamentally strong, its valuations are neutral and technical charts flag a bearish bias. He recommends avoiding chasing the stock, and instead waiting for a breakout above ₹1,645 or a pullback towards ₹1,445 for long-term entry.

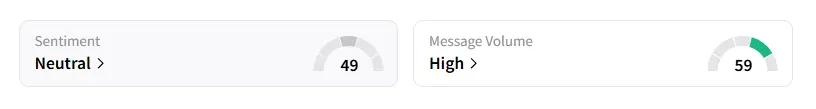

Data on Stocktwits shows that retail sentiment is ‘neutral’ amid ‘heavy’ message volumes.

Infosys shares have declined 17% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2244297865_jpg_34f8b38611.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_corsair_gaming_jpg_f2eebff8d4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2232147590_jpg_a31aecbfad.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_US_stocks_3e2253bcca.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Revised_Profile_JPG_0e0afdf5e2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2214866166_jpg_efcc3db1cd.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_original_jpg_285085becb.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)