Advertisement|Remove ads.

Intel Shares In Focus As Analysts Express Caution Amid Historic Low, But Retail Sentiment Remains Bullish

Intel Corp. ($INTC) shares were flat in pre-market trading on Thursday, with retail sentiment leaning bullish as investors await the company’s third-quarter earnings after markets close.

Wall Street anticipates earnings of $0.02 per share and revenue of $13.02 billion, though Intel has fallen short of revenue projections in the last two quarters.

Analysts express concern that this trend may persist, noting Intel’s stock is already at a 20-year low, with minimal downside risk but also a lack of immediate growth drivers.

Stifel highlighted the importance of long-term process advancements for Intel’s competitive standing, while Goldman Sachs points to potential challenges in the PC, CPU and FPGA segments.

Goldman also pointed out that Intel is likely to continue relying on Taiwan Semiconductor Manufacturing Company ($TSM) for some part of its CPU production beyond 2025 – something that may be hurting Intel’s margins.

According to a report by Reuters, when Pat Gelsinger became Intel’s CEO in 2021, he made the “big mistake” of offending TSMC by highlighting Taiwan’s precarious relations with China.

Intel had previously enjoyed a favorable partnership with TSMC, which produced Intel-designed chips at a significant discount.

After Gelsinger's comments, TSMC revoked the discount, sources told Reuters. This has resulted in Intel paying full price for $23,000 3-nanometer wafers, which has hurt its profit margins.

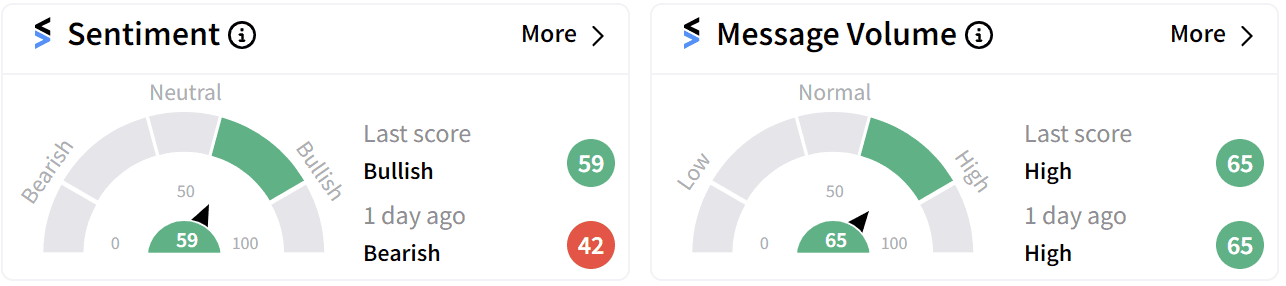

Retail sentiment on Stocktwits had flipped from ‘bearish’ to ‘bullish’ (59/100) ahead of earnings, as markets opened on Thursday, alongside consistently ‘high’ (64/100) chatter.

Since August, Intel has implemented a series of aggressive cost-cutting measures, including a 15% workforce reduction and suspension of its dividend.

The company also plans to reduce or exit two-thirds of its global real estate portfolio by year-end and has started selling part of its stake in Altera, its programmable chip business.

There are also indications of potential significant investments in Intel. Apollo Global Management ($APO) is said to have proposed a $5 billion equity-like investment in the company. Earlier this month, there were also reports that Qualcomm ($QCOM) reached out to Intel about a possible acquisition.

Intel shares have plummeted over 50% so far this year.

For updates and corrections email newsroom@stocktwits.com.

Read more: Alphabet Stock In Green After Earnings Top Estimates: Retail Exuberance Continues

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228080229_jpg_dba4a8dbc2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_arthur_hayes_OG_jpg_734ff95af6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_jpg_eb6402d336.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_winklevoss_1c7de389e0.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Webull_stock_resized_jpg_48b42f4c8f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2247874160_jpg_4fb51355e6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)