Advertisement|Remove ads.

Intel Stock Slips Pre-Market On Reports Of Silver Lake Buying Majority Stake In Altera Unit: Retail Remains Bullish

Intel Corp. (INTC) shares slipped as much as 2% in premarket trading Wednesday after a Bloomberg report stated that Silver Lake Management is in advanced talks to acquire a majority stake in Intel’s programmable chips unit, Altera.

The potential deal follows speculation that Intel could be split up in a transaction involving Taiwan Semiconductor Manufacturing Co. (TSMC) (TSM) and Broadcom (AVGO) — a rumor that sent the stock soaring to its biggest single-day gain in nearly five years on Tuesday.

Sources told Bloomberg that discussions around Silver Lake’s investment in Altera, whose programmable chips are widely used in telecommunications networks, are at an “advanced stage.”

The exact size of the stake remains unclear, and the deal is not guaranteed, as discussions could still be delayed or fall through.

Intel and Silver Lake have so far declined to comment on the report.

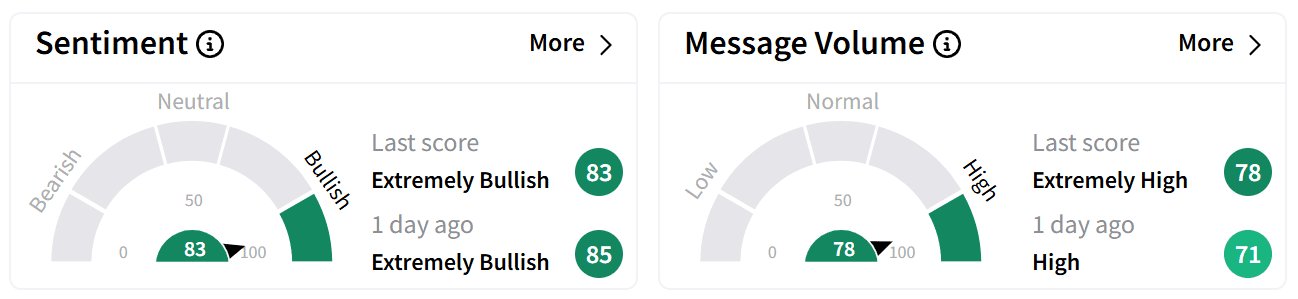

Despite the pre-market correction, retail sentiment on Stocktwits around Intel remained in the ‘extremely bullish’ zone as chatter increased to ‘extremely high’ levels.

One user said the U.S. government’s push for local chip manufacturing is reason enough to remain long on the stock.

Many others predicted that Intel shares could reverse course when markets open, potentially moving to $30.

Intel first announced plans to sell a stake in Altera last year as part of a broader restructuring effort. In November 2024, reports suggested that Lattice Semiconductor Corp. (LSCC) and a consortium of private equity firms had expressed interest in the business.

Intel has ceded market share to rivals in recent years and has lagged in AI accelerator development. The company’s turnaround efforts have been slow, prompting the board to remove CEO Pat Gelsinger last year. Intel is still searching for a successor.

Intel’s stock has climbed more than 35% in 2025 but remains down 38% over the past year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1227710498_jpg_fbb12d04bf.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233918556_jpg_1c5248e175.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227669377_jpg_9a115c3623.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227231004_jpg_0de480c6f4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2254924041_jpg_892ccf911d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1234736300_jpg_881ee00045.webp)