Advertisement|Remove ads.

IonQ Reportedly In Talks To Buy ID Quantique In $250M Deal: Retail Bullish On Stock

IonQ, Inc. (IONQ), which manufactures high-performance quantum computers, is reportedly eyeing a mid-ticket merger and acquisition transaction.

The College Park, Maryland-based company was in advanced talks to buy ID Quantique, valuing the latter at $250 million, Bloomberg reported, citing a person with knowledge of the matter.

Geneva, Switzerland-based ID Quantique provides quantum key distribution systems, quantum-safe network encryption, single photon counters and hardware random number generators.

The Bloomberg report said the transaction, to be financed in IonQ stock, could be announced as early as this week.

If IonQ clinches the deal, it will mark a back-to-back transaction following its purchase of all the assets of the quantum networking company Qubitekk in late January.

IonQ went public in October 2021 following a merger with a Special Purpose Acquisition Company (SPAC). It is the first publicly listed quantum computing company.

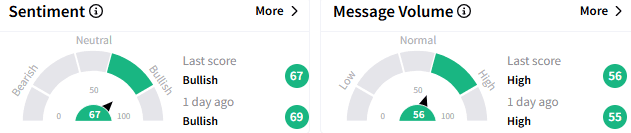

On Stocktwits, sentiment toward IonQ stock remained ‘bullish’ (68/100), with the message volume at a ‘high’ level.

A bullish watcher saw Tuesday’s weakness as a buying opportunity.

Another said a sharp pullback below the $20 level is unlikely, given the deal would lead to the dilution of only 8 million shares even if it is structured as an “all-stock” transaction.

IonQ stock has lost over 25% since the start of the year, giving back some of the 150%+ gains it recorded in 2024.

The stock was down 6.10% to $29.33 in the mid-session.

For updates and corrections, email newsroom@stocktwits.com

Read Next: Workday Q4 Earnings Round The Corner: Analysts, Retail Worry About Stock’s Valuation

/filters:format(webp)https://news.stocktwits-cdn.com/large_Circle_Internet_jpg_add0182c9c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263898051_jpg_9e75888009.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262920033_jpg_f596c67fd3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1227710498_jpg_fbb12d04bf.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233918556_jpg_1c5248e175.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227669377_jpg_9a115c3623.webp)