Advertisement|Remove ads.

Workday Q4 Earnings Round The Corner: Analysts, Retail Worry About Stock’s Valuation

Pleasanton, California-based Workday, Inc. (WDAY) is scheduled to report its fiscal year 2025 fourth-quarter results after the closing bell on Tuesday.

The Finchat-compiled consensus calls for adjusted earnings per share (EPS) of $1.78 and revenue of $2.18 billion, up 13.5% year over year (YoY). In the year-ago quarter, the company reported an adjusted EPS and revenue of $1.157 and $1.92 billion, respectively.

Workday stock pulled back following the company’s third-quarter results in late November as investors did not take kindly to the company’s full-year subscription revenue guidance cut.

Given the precedence, the forward guidance for the first quarter and the current fiscal year is expected to determine the stock's near-term direction.

Investors may also focus on other key metrics, such as the fourth-quarter subscription revenue, which was guided to $2.025 billion, adjusted operating margin , estimated at 25%, 12-month subscription revenue backlog, and operating cash flow.

Last week, Morgan Stanley analyst Keith Weiss downgraded the stock to ‘Equal-Weight’ from ‘Overweight’ and reduced the price target to $275 from $330. Among the pushbacks mentioned by the analyst are recent negative revisions, headcount reductions, Workday’s go-to-market investments not paying off as expected, and weak fourth-quarter results from enterprise software companies.

Loop Capital also has a ‘Hold’ rating on Workday stock with a $260 price target, while Goldman Sachs rates it ‘Buy’ with a $310 price target.

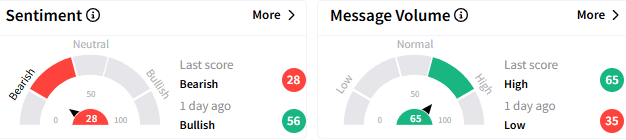

On Stocktwits, retail sentiment toward Workday stock turned to ‘bearish’ (28/100) from the ‘bullish’ mood that prevailed a day ago. However, the message volume improved to ‘high’ levels.

Some retail watchers said it is too risky to hold the stock at its current high valuation. The stock trades at a forward price-to-earnings (P/E) multiple of 32.1.

The stock has gained about 1.5% since the start of the year. On Tuesday afternoon, it traded down 1.57% at $257.70.

For updates and corrections, email newsroom@stocktwits.com

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Cybersecurity_jpg_bb1da91dbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Vanda_jpg_943c16fa4f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2222341271_jpg_26b9066cf6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2249860620_jpg_2bd9e54f08.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2222819201_jpg_edcbb1336e.webp)