Advertisement|Remove ads.

IREN Stock Surged 15% Today – Here’s A Price Target Update

IREN stock drew the spotlight on Wednesday as momentum around data centers remains high due to demand for infrastructure in the artificial intelligence space.

Arete Research has initiated coverage on IREN with a ‘Buy’ rating, according to TheFly. The firm has set a price target of $78, signaling strong upside potential driven by artificial intelligence (AI) infrastructure and bitcoin mining operations.

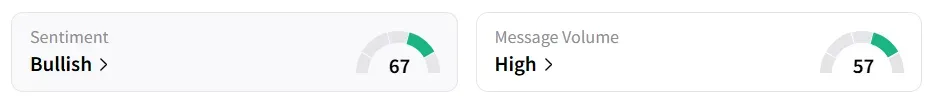

IREN stock traded over 15% higher on Wednesday morning and was among the top five trending equity tickers on Stocktwits. Retail sentiment around the stock remained in ‘bullish’ territory amid ‘high’ message volume levels.

The stock saw a 431% increase in user message count over the past month.

Arete highlighted that growing demand from AI-related computing is likely to provide sustainable growth opportunities for miners like IREN, which are actively aligning their business models to capitalize on this trend.

According to the firm, the Bitcoin miner has recently made strategic moves to expand its role in the broader digital infrastructure space. IREN stands out by funding its own data center development while also modernizing its crypto mining operations.

On Tuesday, IREN said it has doubled its AI Cloud capacity to a total of 23,000 GPUs (graphic processing units), supporting the company’s goal of achieving more than $500 million in annualized AI Cloud revenue by the first quarter of 2026.

To meet increasing demand from enterprise customers, the company invested approximately $674 million to acquire 12,400 additional GPUs, including 7,100 NVIDIA B300s, 4,200 NVIDIA B200s, and 1,100 AMD MI350Xs.

IREN stock has gained over 389% in 2025 and over 435% in the last 12 months.

Also See: Micron Stock Draws Investor Attention As Wall Street Praises Q4 Print, Outlook

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_lantheus_jpg_e10c71c486.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_nio_battery_swap_jpg_de98f34bea.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_anthropic_OG_jpg_51bd14bc5d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2233516954_jpg_72241a7246.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Oil_tanker_resized_jpg_bb40d4bd7e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)