Advertisement|Remove ads.

Is Starbucks China Really Worth $10B? Why Analysts Feel Rumored Valuation Is A Bit Too Rich

Starbucks is considering a partial or full sale of its China business, with a recent news report suggesting that it could be valued at up to $10 billion. However, analysts caution that this may be an ambitious figure, given the rising competition in the Chinese market and waning consumer interest in Starbucks cafes.

"This may be overvaluing the business and not placing enough weight on how competitive China's coffee market is, or how much Starbucks is currently struggling to create a clear identity in the market," Ben Cavender, managing director of China Market Research Group, told CNBC on Thursday.

Starbucks is engaged in talks with potential investors, and a bidding process is underway. The plan to explore strategic options for the China business began as early as late last year, according to media reports, and now Starbucks may be considering a complete sale, rather than its earlier plan to bring in a minority investor.

"We expect $10B would need to reflect the buyer's view that there is room to quickly recoup sales lost during COVID," or improve its profitability, analysts at Citi said in a note Thursday.

TD Cowen said a valuation range of $2.6 billion to $4.7 billion is "more realistic."

Starbucks, which opened its first cafe in China in 1999, has faced increasing competition from lower-priced local rivals, such as Luckin and Cotti, in recent years. Globally, the company is also navigating headwinds as consumers pull back on discretionary spending due to frail economic conditions in several places.

Starbucks' revenue from China has declined from $3.7 billion in 2021 to $3 billion in the previous year, despite opening hundreds of new stores. Last month, Starbucks cut prices on some of its beverages in China.

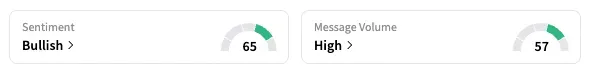

On Stocktwits, the retail sentiment for the coffee chain's stock remained 'bullish,' unchanged from a week ago. SBUX shares have gained 4% year-to-date.

"Consumers are rejecting their products at current prices," and Starbucks will need to cut prices, one user said.

The plan for the China business is part of a business revival strategy under Brian Niccol, who took over as Starbucks CEO in October last year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read Next: Nike Replaces Converse Chief To Revive Iconic Canvas Sneaker Brand

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2252194207_jpg_9605cd50d5.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2247687123_1_jpg_5a8fc404b7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_opendoor_OG_jpg_55300f4def.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2243334218_jpg_b1b7c1b222.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Johnson_and_Johnson_jpg_bc42927ca0.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2207639540_jpg_4ae2641504.webp)