Advertisement|Remove ads.

Starbucks China Bidding Heats Up? Coffee Giant Reportedly Weighs Offers For Controlling Stake

Starbucks (SBUX) has received proposals from prospective investors in its China business, according to a report by Bloomberg News on Wednesday. The majority of the proposals offer to buy a controlling stake in the operation, compelling the coffee chain to reconsider its earlier strategy to offload a minority stake.

Bids for Starbucks China have valued it at up to $10 billion, according to a separate report in CNBC, which cites three people familiar with the deal process.

The Seattle-based company is currently reviewing proposals and shortlisting potential investors for the next round of bidding, according to the Bloomberg report, which cites people familiar with the matter.

While Starbucks' preferred option is to sell a minority stake to a partner, which can also help run the Chinese operations, it may now consider selling a larger holding. Prospective bidders include industry players and private equity firms.

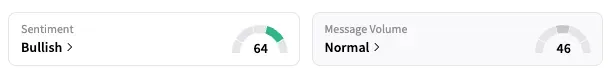

On Stocktwits, the retail sentiment for Starbucks remained 'bullish,' unchanged from a week ago. SBUX shares are up 3.7% year-to-date.

The news about Starbucks exploring options and courting investors has been circulating in the U.S. media for some time. Following those reports, CEO Brian Niccol confirmed the talks last month and told the Financial Times that potential investors had shown "a lot of interest."

Starbucks, which opened its first cafe in China in 1999, has faced increasing competition from lower-priced local rivals, such as Luckin and Cotti, in recent years. Globally, the company is also navigating headwinds as consumers pull back on discretionary spending due to frail economic conditions in several places.

The plan to offload a stake in the business is part of a business revival strategy under Niccol, who took over as CEO in October last year.

Starbucks has eliminated over 1,000 jobs and is implementing a strategic overhaul that includes redesigning store layouts and integrating technology into barista workflows.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Salesforce_tower_742a3d12fa.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_jpg_eb6402d336.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_coinbase_new_jul_2eaf8eb2ac.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2254924116_jpg_d54ffea07e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_dogecoin_OG_2_jpg_304df31f25.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2265300941_jpg_bae5290201.webp)