Advertisement|Remove ads.

Is Tata Motors Stock A Good Swing Trade? SEBI RIA Financial Independence Spots Opportunity At These Key Levels

Tata Motors has shown a bullish price structure with higher highs and higher lows since April, according to SEBI-registered research firm Financial Independence.

The stock remains in a consolidation pattern beneath ₹740–₹750, while any rise above ₹750 may lead to additional gains.

The firm cautioned that if the stock breaks below ₹660, it may decline toward ₹620 or even ₹600.

Financial Independence said that Tata Motors is an attractive option for swing and medium-term investors because of its solid foundation, highlighted by electric vehicle development, Jaguar Land Rover's comeback, and strong commercial vehicle sales.

At the time of writing, Tata Motors shares were trading at ₹718.85, down ₹10.15 or 1.39% on the day.

Recently, Tata Motors reported paying ₹38,892 crore as global taxes and other contributions during FY25, slightly less than the ₹39,344 crore spent in FY24.

The amount collected from direct donations, including corporate income tax, cess, and surcharge, fell to ₹25,766 crore compared to ₹29,199 crore from the previous year.

Payroll-related taxes saw a 31% increase to ₹12,189 crore as indirect contributions, while other employee-related provisions grew from ₹861 crore to ₹937 crore.

The consolidated net profit for Q4 FY25 stood at ₹28,149 crore, a decrease from ₹31,807 crore in the same quarter last year.

The company reported an annual revenue increase to ₹4.4 lakh crores from ₹4.3 lakh crores in FY24.

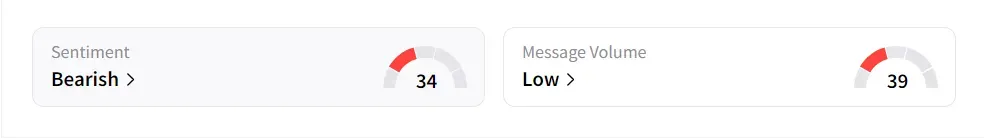

On Stocktwits, retail sentiment was ‘bearish’ amid ‘low’ message volume.

The stock has declined 4.1% so far in 2025.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_adam_smigielski_K5m_Pt_O_Nmp_HM_unsplash_f365ee93f4.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_jpg_fc59d30bbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1190665957_jpg_92088206ed.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2235337192_jpg_56c00409cf.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_marvell_logo_OG_jpg_dfc748dd9b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2232147590_jpg_a31aecbfad.webp)