Advertisement|Remove ads.

Is The AI Bubble About To Pop? Big Tech’s Debt Tab Is Growing, And Investors Are Starting To Squirm

- Famed investor Michael Burry, who has previously flagged risks with Nvidia and Palantir, said that AI-linked tech valuations might unravel in two years.

- With Microsoft reportedly cutting some targets for AI product sales, more signals are now emerging of an AI bubble.

- Investors are also growing increasingly concerned over the massive amounts of debt Big Tech is taking on.

Even as markets have rebounded from last month’s broad sell-off, sparked by worries that Big Tech valuations had become overheated, the drumbeat of an “AI bubble” only seems to be getting louder.

Michael Burry, of the “Big Short” fame, said on Wednesday that AI-driven valuations would unravel in two years – a worrisome forecast from the investor who predicted the 2008 housing market crash.

Speaking on the “Against The Rules: The Big Short Companion” podcast hosted by Michael Lewis, Burry likened the AI euphoria to the dot-com era, when stocks peaked well before the market spent on the underlying technology.

He argued that many hyped AI companies, notably Palantir, are mostly doing “consulting,” making their valuations hard to justify. He expects a broad, drawn-out market decline because passive index funds are heavily concentrated in AI names, and recommends that investors instead load up on healthcare stocks.

Chorus Growing

Albeit high-profile, Burry is only the latest of a dozen highly regarded investors and CXOs to err on the side of caution at a time when tech companies are spending money like water on AI development, data centers, and chips, and seeing their market valuations soar to record highs. Critics say future revenue – and the return on current investment – might not be that great.

An August study by MIT showed that about 95% of generative AI projects at companies were failing. A more recent report by Bain said AI companies would need at least $800 billion more, beyond the revenue they generate, in 2030 to make their cloud payments.

In a separate development on Wednesday, Microsoft shares sank after The Information reported that several divisions at Microsoft had lowered quotas for how much salespeople are supposed to increase sales of certain AI products, following many of them missing their targets in the fiscal year. If true, that’s another signal of companies’ resistance to paying for AI.

From AI Bubble To Debt Bubble

Nvidia CEO Jensen Huang disagrees. "There's been a lot of talk about an AI bubble," he said on the company’s third-quarter analyst call last month. "From our vantage point, we see something very different." The AI bellwether reported another blowout quarter, but, strangely, the shares fell the next day.

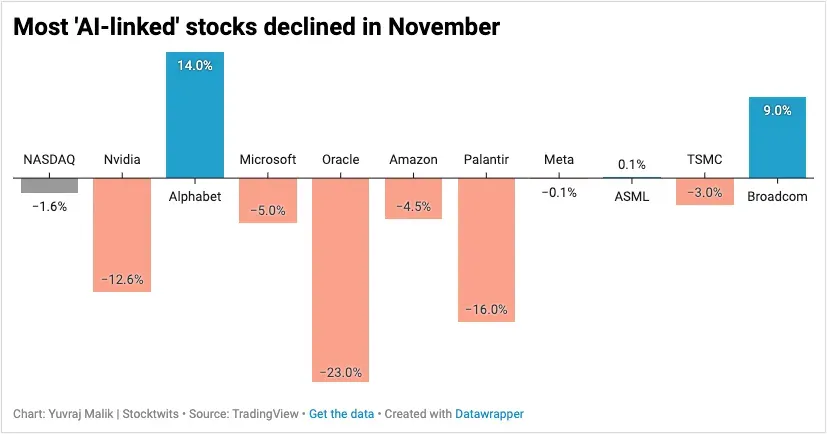

In fact, the majority of the “AI-linked” stocks declined last month (see chart).

Revenue returns aside, investors and analysts are getting jittery about the massive amount of debt cloud companies, also known as hyperscalers, are taking on.

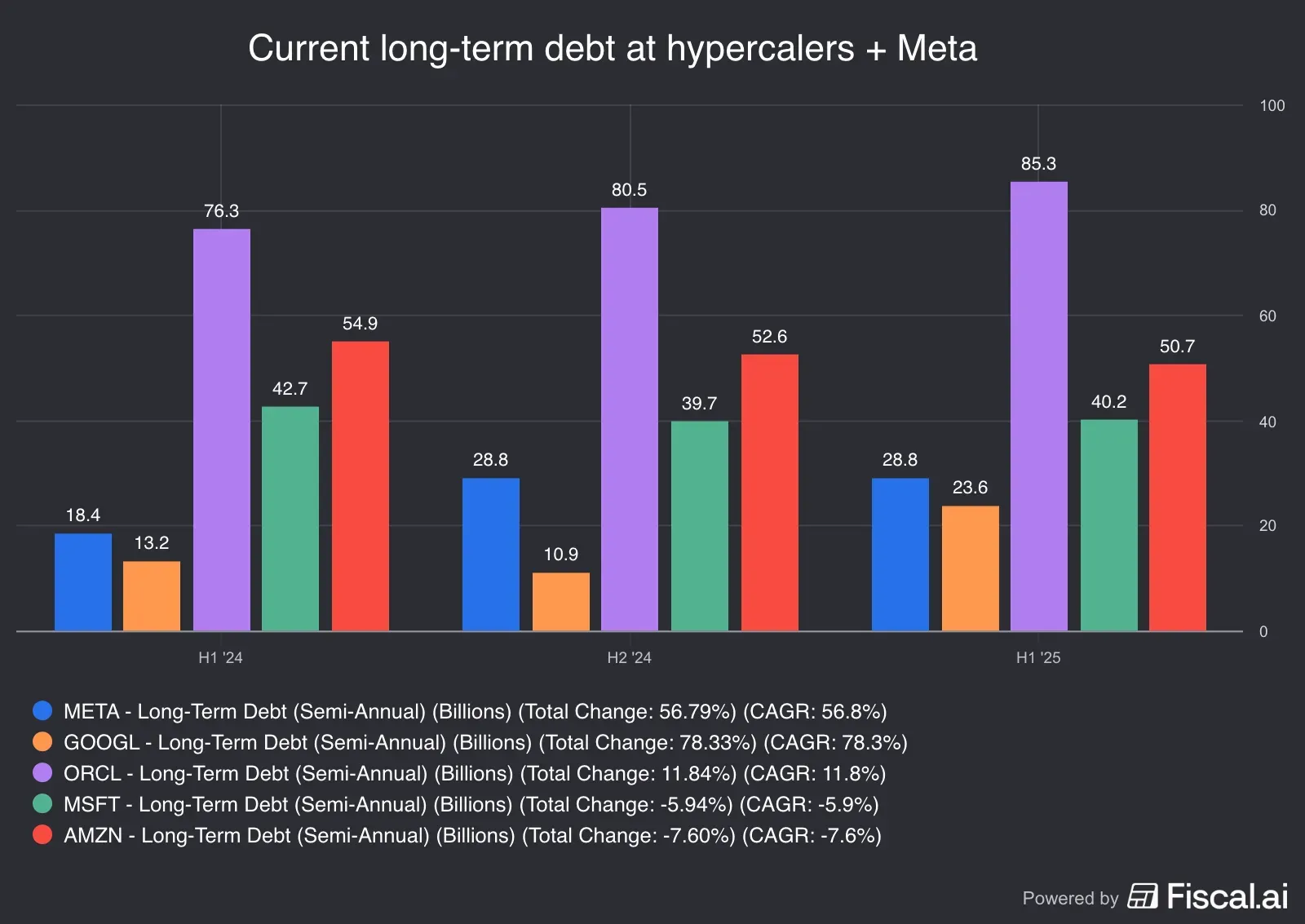

In an analysis last month, Bank of America analysts said that Amazon, Google, Meta, Microsoft, and Oracle have together raised $121 billion of investment-grade debt this year. Of that, about $75 billion was issued in September and October alone, amid two interest rate cuts, which is more than double the sector's average annual issuance during the prior decade, BofA data shows.

According to the latest Fiscal AI data, the five companies' long-term debt totaled $228.6 billion as of June-end. That’s 11.2% higher than the same time last year.

In the AI land, cracks are emerging, and investors are proceeding cautiously. One could say the writing was on the wall after SoftBank sold its entire Nvidia stake, worth $5.8 billion, in October — interestingly enough, only to spend on new bets such as more AI data centers and Sam Altman’s OpenAI.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2232147543_jpg_a7d6168b5c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Palantir_jpg_d29fd424cd.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2231279747_jpg_9150b71435.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_CME_Group_8b0ca24197.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_OG_oct23_jpg_588046d0a9.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1764993793_jpg_77bd68b18e.webp)