Advertisement|Remove ads.

Is Walmart The Next Trillion-Dollar Company? Recent All-Time Highs, Nasdaq Listing Raises Investor Hopes

- The decision to move to Nasdaq reflects Walmart’s ongoing transformation into a technology-focused retailer.

- Walmart expects 2025 adjusted earnings per share between $2.58 and $2.63.

- Morgan Stanley increased Walmart's price target to $125 from $115.

Walmart Inc. (WMT) stock has been hovering near its all-time high set in October, gradually approaching the $1 trillion market capitalization, as the retail giant raised its annual forecast for the second time this year and moved its listing from the New York Stock Exchange to the Nasdaq.

The retailer’s current market capitalization stands close to $858 billion. The company plans to begin trading on the Nasdaq Global Select Market on December 9, keeping its ticker symbol “WMT.”

Strategic Rationale

The decision to move to Nasdaq reflects Walmart’s ongoing transformation into a technology-focused, omnichannel retailer, integrating AI and automation into its operations.

The move also involves transferring nine of the company’s bonds to Nasdaq, demonstrating Walmart’s broader alignment with technology-driven markets. At the time of writing, Walmart’s stock traded marginally in the red.

Analyst Take

Walmart raised its annual forecast for the second time this year, boosted by robust online sales heading into the holiday season. Adjusted earnings per share for 2025 are now projected between $2.58 and $2.63, up from the prior range of $2.52 to $2.62.

Morgan Stanley increased Walmart's price target to $125 from $115 while maintaining an ‘Overweight’ rating, according to TheFly. The firm cited the resilience of Walmart’s e-commerce engine, noting that adjusted operating income growth has returned to its usual high-single-digit range.

Piper Sandler also raised its price target to $123 from $111 and kept an ‘Overweight’ recommendation, emphasizing "exceptionally strong" performance in the third quarter.

How Did Stocktwits Users React?

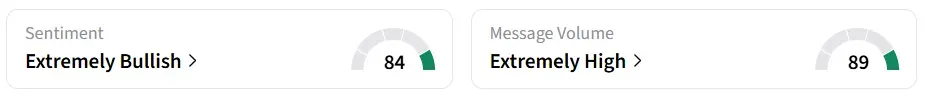

On Stocktwits, retail sentiment around the stock remained in ‘extremely bullish’ territory amid ‘extremely high’ message volume.

The stock saw a 381% increase in user message count over 24 hours as of Friday morning.

A bullish Stocktwits user expressed optimism about the move to Nasdaq.

Another user commended the stock’s potential for long-term growth.

WMT stock has gained over 17% so far in 2025.

Also See: Jensen Huang Says Market Undervalues Nvidia Despite Stellar Quarter: Report

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_janetyellen_resized_jpg_ea2c28f284.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Jamie_Dimon_July_736ff90d31.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2207049226_jpg_7f1e685123.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2218181377_jpg_f2dccc3db9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2245017747_jpg_f783731632.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_China_i_Phone_jpg_bcedab655a.webp)