Advertisement|Remove ads.

ITC Shares Face Near-Term Technical Resistance After Q4 Results: SEBI RA Harika Enjamuri

ITC Ltd’s fourth-quarter (Q4) results show mixed performance with near-term technical weakness, according to SEBI-registered analyst Harika Enjamuri.

The company reported a standalone net profit of ₹19,562 crore for the quarter, largely driven by a one-time exceptional gain of ₹15,179 crore from discontinued operations.

Excluding this, core profit rose just 0.8% year-on-year to ₹4,875 crore, falling short of market expectations.

At the time of writing, ITC Ltd shares were trading at ₹437.80, up 2.75% or ₹11.70

Revenue climbed 9.4% to ₹18,494 crore, supported by a solid cigarette segment that posted a 6% revenue growth to ₹8,399.6 crore and a 4% profit rise to ₹5,117.9 crore.

However, FMCG earnings dropped sharply, with core profit down 20.5% due to elevated input costs, while paper and packaging profits declined 31%, pressured by cheap imports and rising raw material prices.

Emjamuri said ITC’s stock faces resistance near its 50-day and 100-day simple moving averages at ₹432 and ₹427, respectively, closing 1.6% lower at ₹426.10 on Thursday.

The relative strength index (RSI) at 47.96 signals weakening momentum.

On the weekly chart, the stock remains below key resistance levels at ₹444 and the 50-week and 100-week SMAs, with an RSI of 46.12, according to the analyst.

Enjamuri noted support near ₹417 but warned that a drop below this could lead to further declines toward ₹403-₹399.

“Caution is advised unless a strong bullish volume breakout above the moving averages occurs,” she said.

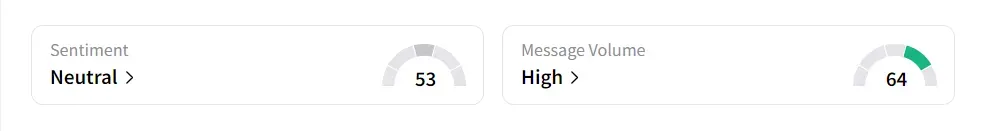

On Stocktwits, retail sentiment was ‘neutral’ amid ‘high’ message volume.

The stock has declined 9.9% so far in 2025.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_adam_smigielski_K5m_Pt_O_Nmp_HM_unsplash_f365ee93f4.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_jpg_fc59d30bbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1190665957_jpg_92088206ed.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2235337192_jpg_56c00409cf.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_marvell_logo_OG_jpg_dfc748dd9b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2232147590_jpg_a31aecbfad.webp)